Bank of Canada Holds Rates Steady Amid Global Economic Challenges

As economists widely expected, the central bank persists with its policy of quantitative tightening in light of global economic challenges. The Bank of Canada maintains its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%.

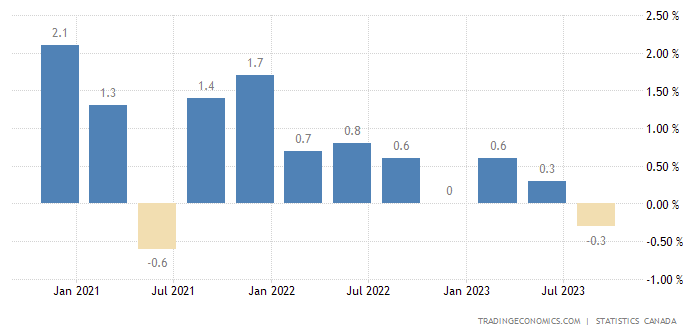

The Bank of Canada highlights that “the economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024”. Data shows that consumers and businesses are cutting spending due to higher prices and interest rates. This can be seen below as Canadian GDP contracted by 0.3% in Q3 of 2023.

Canada GDP Growth Rate (source: tradingeconomics.com)

Canada’s central bank remains “concerned about the risks to the outlook for inflation, particularly the persistence in underlying inflation”. Although on a downward trend, Canada’s inflation numbers slightly increased at the end of 2023 (from 3.1% to 3.4%). This was largely due to 2 factors:

1) An increase in gasoline costs, rising 1.4% compared to November’s decline of 7.7% and,

2) A continued increase in shelter costs rising 6% in December as high mortgage rates place obstacles to home ownership and increased rent prices.

Canada Inflation Rate (source: tradingeconomics.com)

Overall, global growth is slowing, and inflation is gradually easing in most economies. The Bank of Canada anticipates a gradual recovery in the latter half of 2024, foresting “global GDP growth of 2½% in 2024 and 2¾% in 2025”.

The next Bank of Canada rate announcement is March 6th, 2024.

If you have any questions about today’s Market Update, feel free to call us at 604-643-0101 or email cashgroup@cgf.com .

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!