Federal Reserve Maintains Current Interest Rate Amid Elevated Inflation

In the Federal Reserve's latest announcement, they shed light on the United States’ economic performance, indicating that "economic activity expanded at a strong pace in the third quarter." Although job gains have seen a slight moderation from earlier this year, they continue to exhibit strength, with the unemployment rate maintaining its low position.

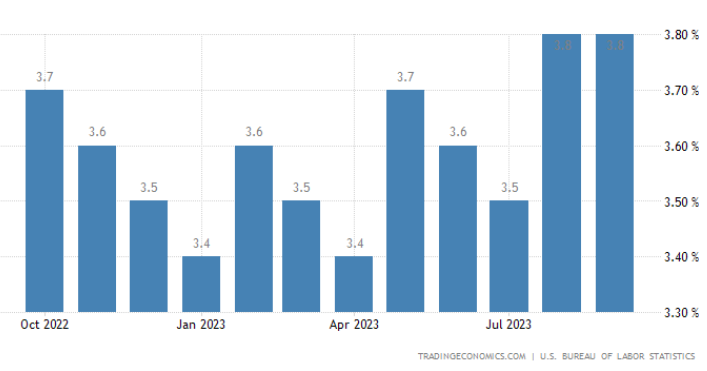

United States Unemployment Rate over the previous 25 years (source: tradingeconomics.com).

Despite the buoyant economic indicators, inflation remains a concern. The Federal Reserve remarked, "Inflation remains elevated," highlighting a potential area of focus for the country's monetary policy.

Given the strong foundation of the U.S. banking system, which is described as "sound and resilient", concerns emerge around tighter financial and credit conditions that might adversely affect households and businesses. Such tightening conditions could potentially "weigh on economic activity, hiring, and inflation." The exact magnitude of these impacts, however, remains uncertain, but the Committee expresses its heightened attention to the risks of inflation.

In light of these dynamics, the Federal Reserve's Committee has made the decision to "maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent." Their commitment to achieving maximum employment and a 2 percent inflation rate over the long run is evident. As part of this strategy, the Committee disclosed its ongoing efforts in "reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities."

The next Fed Rate announcement is slated for January 31, 2024. Leading up to that, the Committee will continue its assessment, taking into account a broad spectrum of information, such as "readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments."

If you have any questions about today’s Market Update, feel free to call us at 604-643-0101 or email cashgroup@cgf.com .

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!