Treasury Bills vs. Treasury Bonds

Fixed-income securities play a vital role in individual and institutional investment portfolios and the broader economy. Our federal and provincial governments offer fixed-income securities to consumers and investors to fund operations, including Treasury Bills and Treasury Bonds.

Treasury Bills, also known as T-Bills, and Treasury Bonds, also known as T-Bonds, are debt instruments where investors lend the government the face value of the bond and in return, investors are paid interest.

When the bill or bond matures, investors are paid back the face value of the security.

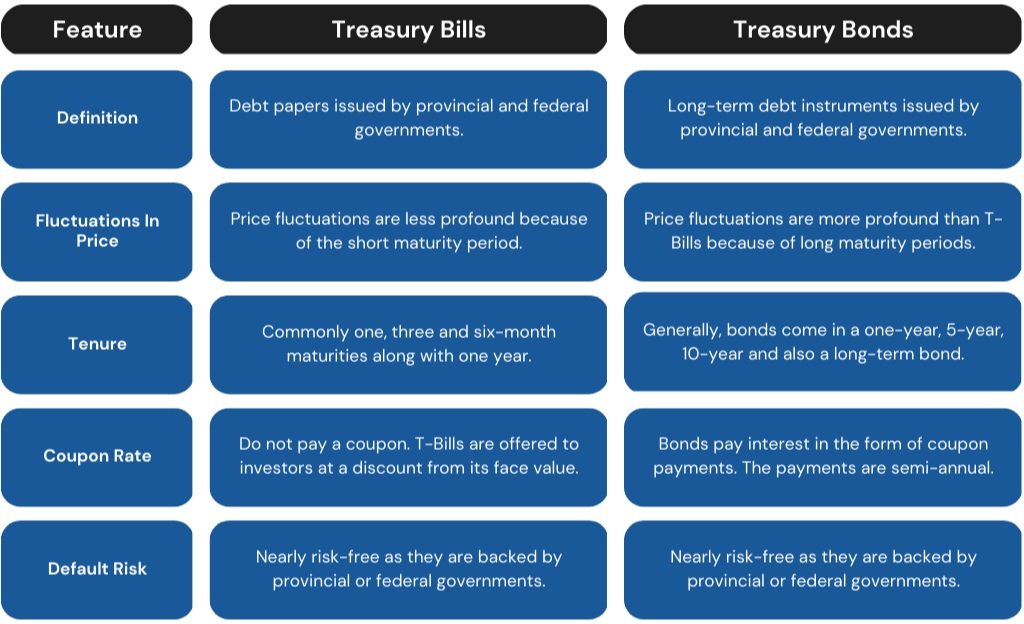

T-Bills and T-Bonds vary in some ways, such as maturity dates, risk, pricing and payments.

What is a Treasury Bill?

Treasury Bills are debt securities issued by federal and provincial governments. Investors can buy them directly from a financial institution or from a securities broker.

T-bills are commonly issued in denominations of $1,000, $5,000, $10,000, $25,000, $50,000, $100,000 and $1 million. The issues can vary depending on the financial institution or broker and may have their own minimum investment threshold of several thousand dollars.

In general, T-Bills are short-term investments that can be issued anywhere from a month to a year.

T-Bills are 100% guaranteed by the government that issues them, making them one of the safer investments available in the Canadian market. That said, with such a low risk it also carries with it a relatively low yield

What is a Treasury Bond?

Treasury Bonds are debt instruments issued by federal and provincial governments in order to raise funds. In Canada, a T-Bond is typically called a Government of Canada bond. Bonds are issued for a tenure of more than two years. Generally, you will find bonds issued as two years, five years, ten years and also 30 years.

Bonds pay investors a coupon, typically on a semi-annual basis. The coupon is a percentage of the bond’s face value and is usually paid semi-annually, or sometimes quarterly or annually to investors.

For example, a bond issued with a face value of $1,000 and a 7% coupon rate will pay a $35 coupon semi-annually.

At maturity, investors will receive the principal or par amount of the bond.

Bonds issued by governments carry very low risk. In Canada, federal government bonds have less risk than provincial government bonds.

Comparison

What are the differences between T-Bills and T-Bonds? We’ll detail them in the table below so it is easier to understand.

Bottom Line

Treasury Bills are short-term debt securities issued by provincial and federal governments that mature within a year. On the other hand, bonds come in far more variations with much longer maturity periods.

Fixed-income securities issued by the federal and provincial governments are very low-risk investments, but the flip side of that is they typically have lower yields.

Why are they low-risk investments? In Canada, government bonds are backed by the full faith and credit of the Canadian government. As bonds are secured by the government, payment of the principal and interest are guaranteed. In Canada’s case, the federal government has never defaulted on its debt.

Whether to invest in a T-Bill or a T-Bond depends on the investor’s time horizon and risk tolerance. If liquidity is needed in the shorter term, then a T-Bill would be preferable. If liquidity is not needed in the shorter term, then a T-Bond with maturities over one year would be better. On most occasions, the longer the maturity, the higher the yield.

As always, if you have any questions about T-Bills or T-Bonds, you can call us at 604-643-0101 or email cashgroup@cgf.com.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!