Bank of Canada continues Quantitative Tightening, Hikes Interest Rate by 25 bps

Governor of the Bank of Canada, Tiff Macklem (Photo via @bankofcanada / Twitter).

Today, the Bank of Canada announced another increase to the overnight rate, increasing it by 25 basis points to 4.5%. This marks the eighth consecutive policy rate increase for the central bank as it continues its push towards quantitative tightening.

Tiff Macklem, the Governor of the Bank of Canada asserted that if economic developments evolve in line with projected forecasts in its Monetary Policy Report, which was published today, it would pause monetary policy tightening. This marks the first major central bank to indicate that it would pause future interest rate hikes.

“We have raised rates rapidly, and now it’s time to pause and assess whether monetary policy is sufficiently restrictive to bring inflation back to the 2% target,” Tiff Macklem said in a news conference.

Global inflation remains high and broad-based. In the United States and Europe, economies are slowing but are more resilient than expected at the time of the central bank’s October Monetary Policy Report.

China’s loosening of Covid-19 restrictions has had a significant upward impact on its growth forecast and poses an upside risk to commodity prices. Russia’s war on Ukraine continues to be viewed as a significant source of uncertainty.

Global supply chains are resolving faster than expected from the central bank’s viewpoint and while they are not quite yet normal in Canada, there has been progress.

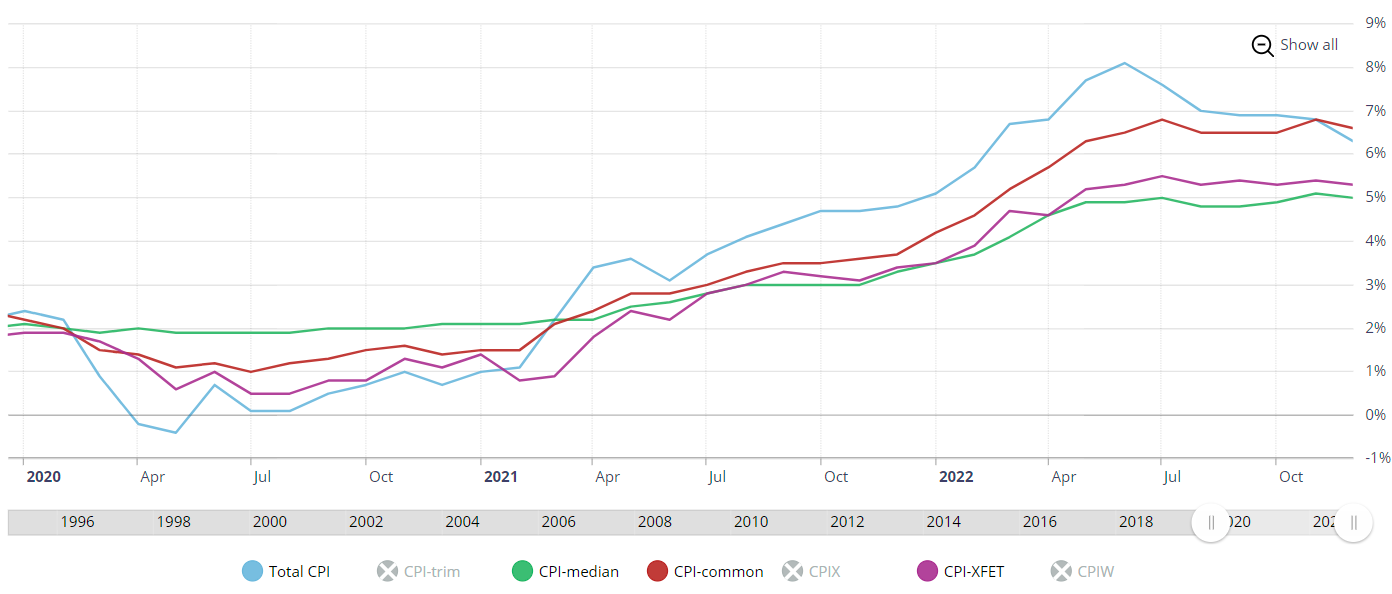

Consumer price index (CPI) inflation declined from 6.8% to 6.3% in December reflecting lower gas prices and moderate prices for durable goods.

Despite this progress, Canadian households are still seeing increases in prices for food and shelter. At this time, short-term inflation expectations remain elevated.

The Bank of Canada is expecting inflation to significantly decline this year to roughly 3% in the middle of 2023 and back to its target of 2% in 2024.

Canada’s Consumer Price Index graphed in total, median, common and XFET since 2020. (Source: bankofcanada.ca).

In Canada, the dollar has been relatively stable against the U.S. dollar, sitting between 73 to 75 cents per CAD since October.

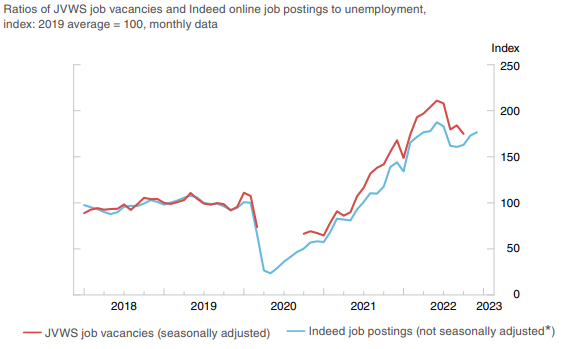

Labour markets remain tight and the unemployment rate is near historic lows. That said, job vacancies and postings have started to decline, meaning businesses may have less difficulty finding workers in the near future.

Job vacancies and postings have declined from their peaks but remain high. (Source: Statistics Canada, Indeed and Bank of Canada calculations).

Macklem did indicate there are risks surrounding the central bank’s projections. First, global energy prices could increase. Second, high labour costs could continue to persist, helping inflation to stay elevated.

If these risks materialize, the Bank of Canada will have to raise interest rates further, a possibility that the central bank is prepared for, as indicated by today’s announcement.

“[The] Governing Council is prepared to increase the policy rate further if needed to return inflation to the 2% target, and remains resolute in its commitment to restoring price stability for Canadians.”

For the first time, the Bank of Canada will publish its meeting minutes on February 8, 2023.

The next scheduled date for announcing the overnight rate target is March 8, 2023. The central bank intends to publish its full outlook for the economy and inflation in the Monetary Policy Report on April 12, 2023.

The guidance we give our clients remains the same. Invest in blue chip stocks and take advantage of the rising interest rate environment with some short-term fixed-income securities such as bonds and Guaranteed Investment Certificates.

As always, if you have any questions about today’s Market Update, you can call us at 604-643-0101 or email cashgroup@cgf.com.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!