Fed Holds Rates as Inflation Remains Elevated

In a recent update, the Federal Reserve has signaled its intention to hold interest rates steady. Although they cite continued economic growth and strong job market performance the persistence of elevated inflation levels remains a central concern, complicating the Fed's policy decisions as it strives to stabilize prices without stifling economic expansion.

The annual inflation rate in the United States rose to 3.5% in March 2024, marking the second consecutive month of acceleration and reaching its highest level since September 2023. When viewing the inflation rates from a broader perspective, it's evident that although there has been a notable decrease from the peaks of 2021 and 2022 inflation continues to be high compared to the rates observed in earlier years (10 year U.S. inflation graph below).

10 year U.S. Inflation Rate (source: https://tradingeconomics.com/united-states/inflation-cpi)

The Federal Reserve follows a dual mandate, to stabilizes prices, but also to foster maximum employment. "Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low," the Federal Reserve noted in its latest briefing. The graph below charts U.S. unemployment since 1948, illustrating how current levels are low in a historical context.

U.S. unemployment since 1948 (source: https://tradingeconomics.com/united-states/unemployment-rate)

Starting in June, the committee plans to cut the monthly redemption cap on treasury securities by more than half (from $60 billion to $25 billion). It will keep the redemption cap for agency debt and agency mortgage-backed securities steady at $35 billion, reinvesting any principal payments that exceed this cap back into treasury securities. This change should put further downward pressure on interest rates.

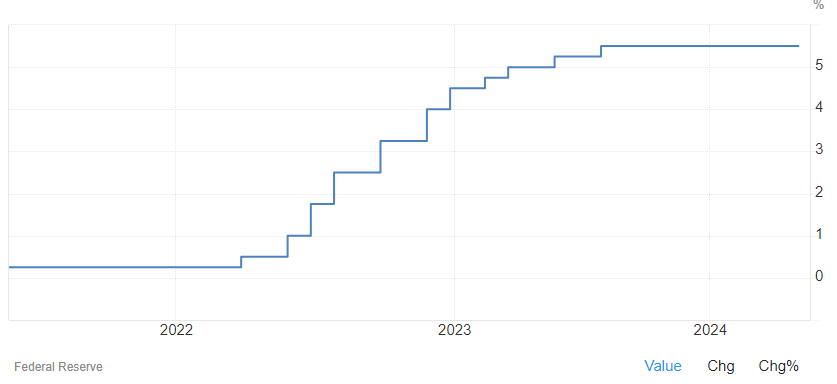

U.S. Federal Funds Rate (source: https://tradingeconomics.com/united-states/interest-rate)

The Federal Funds rate has been maintained at a steady level since July 2023 (Three year federal funds graph above). According to the recent FOMC statement, "The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward two percent". As we wait to see inflation normalize, we continue to experience the effects of sustained higher rates.

The next Federal Reserve rate announcement is June 12th, 2024.

If you have any questions about today’s Market Update, feel free to call us at 604-643-0101 or email cashgroup@cgf.com .

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!