Fed Raises Rates By 50 bps, Expectations for Median Rate in 2023 Increases

On Wednesday, the Federal Open Market Committee (FOMC) issued a statement, agreeing to raise its key short-term interest rate by 50 basis points (bps), pulling back from recent outsized hikes as it aims to control soaring inflation.

The Fed’s target range for the federal funds rate now sits in the range of 4.25% to 4.5%. The Committee stated, “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.”

After a two-day meeting, the FOMC has increased its median projection for the federal funds rate in 2023 from 4.6% to 5.1%.

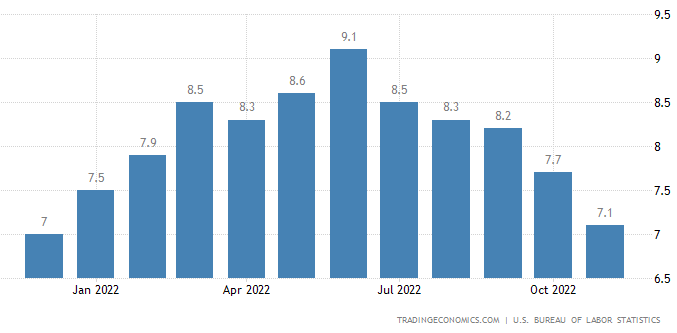

The United States released its consumer price index (CPI) for November on Tuesday, where consumer prices rose 7.1%. That number was down sharply from 7.7% in October and a peak of 9.1% in June. The reading was the fifth straight decline for the CPI.

U.S. President Joe Biden labeled the inflation report as “welcome news for families across the country.” That being said, Biden understood that inflation may not return to “normal levels” until the end of 2023.

U.S. inflation rate in the trailing twelve months as of December 14, 2022. (Source: tradingeconomics.com).

Causes for inflation revolve around supply and demand imbalances from the Covid-19 pandemic, higher food and energy prices, broader price pressures and Russia’s war against Ukraine.

“The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity” the statement reads. The Committee explains that it is “highly attentive to inflation risks.”

The Committee has indicated modest growth trends in spending and production, while job gains have been robust in recent months with the unemployment rate holding steady at 3.7% in the U.S.

If risks emerge that impede the Committee’s goals, it asserts that it is prepared to adjust the stance of monetary policy.

Since the benchmark rate varied around zero in March of this year, the Fed has raised it by more than four points. This is the fastest pace it has done so since the early 1980s.

The hike is expected to impact multiple sectors of the economy, driving up rates for credit cards, home equity lines of credit, adjustable-rate mortgages and other types of loans.

The guidance we give our clients remains the same. Invest in blue chip stocks and take advantage of the rising interest rate environment with some short-term fixed-income securities such as bonds and Guaranteed Investment Certificates.

As always, if you have any questions about today’s Market Update, you can call us at 604-643-0101 or email cashgroup@cgf.com.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!