Federal Reserve Maintains Rates: Market Eyes September Meeting for Possible Cut

On July 31, the Federal Reserve decided to maintain the current target policy rates in the range of 5.25% to 5.5%. Jerome Powell also announced plans to continue reducing the Fed’s holdings of Treasury securities, agency debt, and agency mortgage-backed securities. This move aims to gradually decrease the Fed's balance sheet, which expanded significantly during the pandemic.

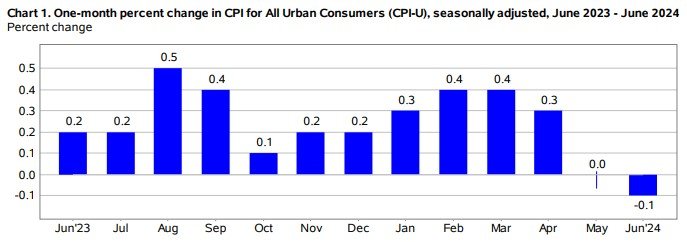

In June 2024, the Consumer Price Index (CPI) showed a decline of 0.1% month-over-month, while increasing by 3.0% year-over-year. Overall, the 12-month percentage change in CPI has been on a downward trend since March. As of June, the national unemployment rate stood at 4.1%. Although unemployment has been rising slightly in recent months, it remains at historically low levels. These figures support the Fed’s hope for a "soft landing" — achieving low inflation while keeping the employment market strong.

Source: Bureau of Labor Statistics - US Department of Labor

Source: FRED Economic Data

The U.S. economy is currently influenced by a mix of positive and negative factors that are largely balancing each other out. Major companies like UPS, Whirlpool, and Lamb Weston reported lower-than-expected corporate earnings in the second quarter, suggesting a potential weakening in consumer demand. This is compounded by rising debt levels among lower-income households, which are reaching their borrowing limits. However, overall consumer spending increased by 2.3% in the second quarter of 2024, up from 1.5% in the first quarter, indicating resilience in the broader economy. Additionally, S&P 500 companies reported aggregate revenue growth of 5% and earnings growth of 10%. The U.S. economy is projected to grow by 1.7% in 2024

The cautious approach to maintaining interest rates at the current level was explained by Jerome Powell, who emphasized the need for confidence in the data before making further policy changes. However, the Fed appears closer to considering a rate cut, and according to Bloomberg's World Interest Rate Probability (WIRP), the market largely expects the Fed to lower the target interest rate at its next meeting on September 18.

World Interest Rate Probability (source: Bloomberg) July 31st, 2024

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!