Guide to RESP Contribution Limit and Rules

It’s September, which means one thing: the kids are back at school. If you are thinking about your loved-one's future and want them to have the option of pursuing post-secondary education, a Registered Education Savings Plan (RESP) enables you to save money for their education while deferring the tax.

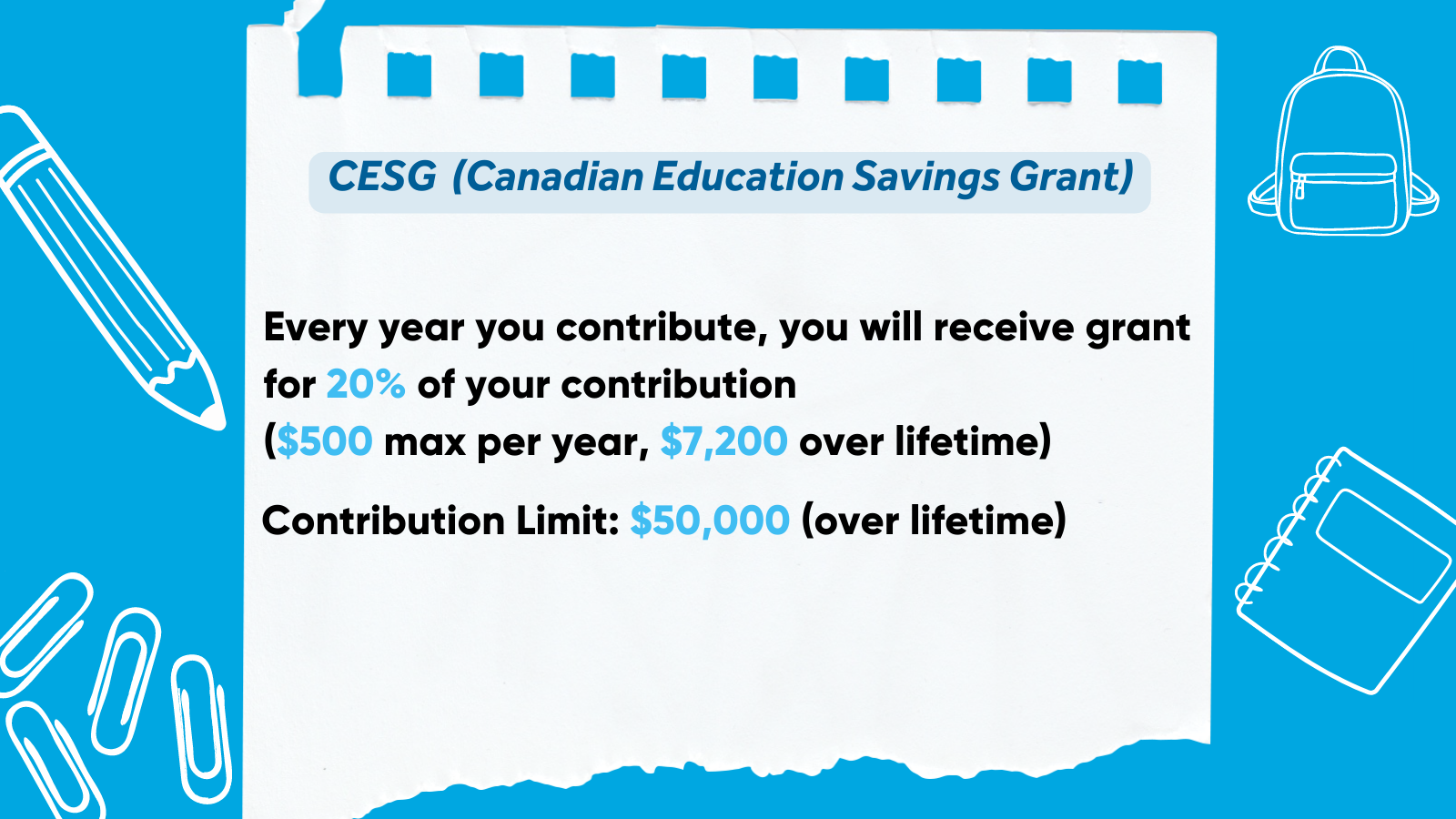

The Federal Government incentivizes putting money aside for higher education by offering additional grant money on top of what you contribute to an RESP. Although they are not particularly complicated, knowing the RESP Rules and Contribution Limits can help you to maximize the government grants available to you.

What is an RESP?

An RESP is a government-sponsored savings plan designed to finance a child's post-secondary education. The federal government provides a Canada Education Savings Grant (CESG) which matches 20% of your contribution, up to $2,500, every year until your child turns 17.

What are the RESP Rules?

The rules around RESP contributions are straightforward, but they are important to keep in mind before you open an RESP. Here is what you need to know:

The maximum lifetime contribution limit is $50,000 per beneficiary.

Although contributions are not tax deductible, growth within the plan is tax deferred and only becomes taxable when the beneficiary enters post-secondary and starts to receive payments from the plan. It is also important to note that the growth is taxed in the hands of the beneficiary, which is usually lower than that of their benefactor.

To ensure you do not go over your contribution room, you should be aware of the plan's limits.

Source: Canaccord Genuity

What is the RESP contribution limit?

When you set up a family RESP for a newborn, the government restricts the amount of CESG you can claim. In summary:

The maximum annual grant per child, up to and including the year they turn 17, is $500. ($2,500 x 20% = $500)

The maximum lifetime CESG per child is $7,200.

Any contribution over $5,000 in a single year is not eligible for the CESG.

If you exceed the $50,000 lifetime limit you will be charged a 1% penalty tax per month.

In order to earn the maximum annual $500, you would need to contribute $2,500.

If the beneficiary ultimately does not pursue post-secondary education, all CESG payments will have to be repaid to the government. However, only the principal on the grants has to be given back and you can keep any income earned on them.

How can I contribute?

There are multiple ways you can invest in an RESP, including cash deposits, mutual funds, stocks, and bonds.

Previously, we looked at some strategies to maximize the value from your RESP. In order to make the most from the grant, the most obvious option would be to pay $2,500 a year from the year the child is born.

However, if you can afford to pay more up front, you can actually get a better overall return.

For instance, if you contribute $2,500 a year for the 17 years of the plan, assuming a 5% rate of return, your ending value will be $79,873, from a total contribution of $42,500 (see graph below).

If you pay $35,000 in the first year, and then $2,500 for the six years after that until you reach the $50,000 lifetime maximum, you actually get a higher return. Assuming the same 5% annual rate of return, employing this strategy would result in a final account value of $116,267.

Under the CESG's carry forward rules, if you do not get the full grant amount each year, any unused grant room accumulates and carries forward until the year a child turns 17. Each year you are able to go back and catch up on missed contributions. The carryforward room is limited to 20% of the first $5,000 in any given year.

The deadline for this calendar year to contribute to your child's RESP is December 31.

Should you need to play catch up, our advisors can help you with creating a custom contribution strategy to enable you to achieve the most value possible.

If you would like to talk about a new or existing RESP, do not hesitate to reach out to us at 604.643.0101.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!