"Oil" Rally Continues; US Unemployment Figures Announced

Recent trading days fall into four groups:

Days where everything is down

Days where everything is up

Days where defensive names are up and offensive names are down.

Days were offensive names are up and defensive names are down

Today fell into the last category, which typically comes with good news about COVID-19. The major indexes were close to flat, with the Dow Jones Industrial Average up 0.2% and the S&P/TSX Composite down 0.3%. The names that are most often cited as being resilient to COVID-19s challenges, including Dollarama, Peloton, and the big banks were down. The names that are being hurt the most by COVID-19, including Air Canada, Boeing, and Delta Airlines, were all up.

That pattern falls in line with what we have typically seen on "good news about COVID-19" days. This is surprising, because today's big COVID-19 headline is that remdesivir is not actually beneficial for the treating the virus.

Oil is Either Infinitely More Valuable Or Trending Down, Depending on How You Define "Oil"

The biggest winner of the day was oil, which gained more than 20% today. That's if you rely on WTI front-month contracts for your definition of the oil price, which (as we established earlier this week) maybe you shouldn't. Using that measure, oil is 50% more valuable than it was two days ago, and #DIV/0% more valuable than it was three days ago:

WTI Price - Source: Bloomberg, April 23rd

WTI isn't just cheap, it's cheaper than it was in 1870. Brent crude, the other measure for the price of oil, was up just 6% today, and that chart paints a different picture:

Source: Bloomberg, April 23rd

The chart above reflects a commodity that has trended down in value this year, and recently picked up a little. No mind-melting negative values there. While it's important to keep an eye on the price of WTI, consider using Brent crude as your measure of "the price of oil", the commodity we all know and love.

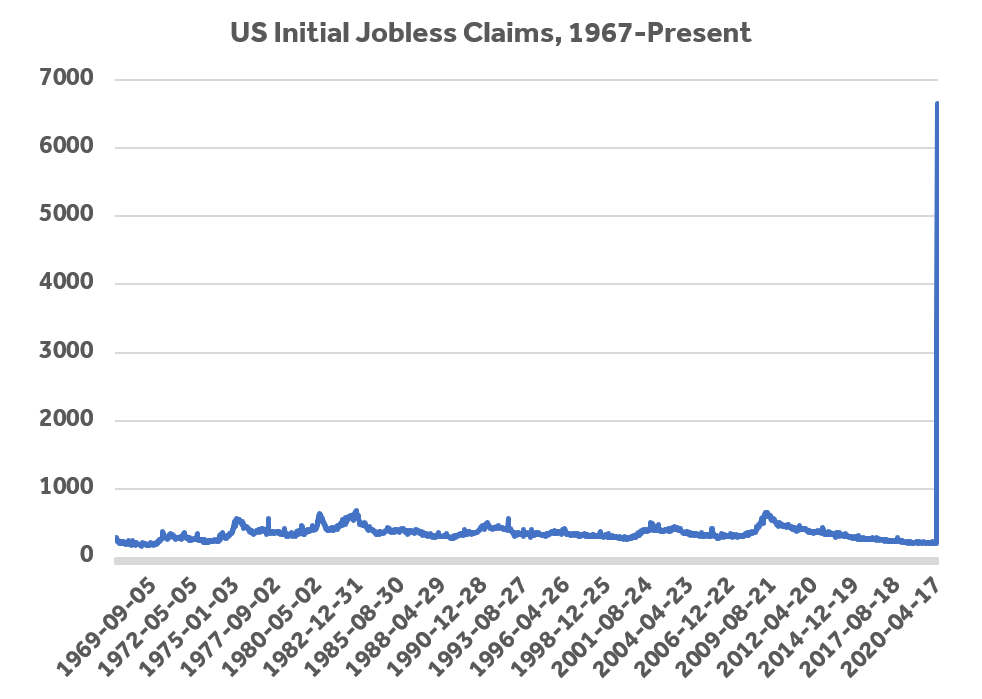

26.2 Million Americans File Initial Jobless Claims in Five Weeks

Equity markets are going to swing back and forth with every piece of news about this drug trial or that, but keep US initial jobless claims in the back of your head. There's a lot of little problems we can solve along the way, but the number of people who have lost their jobs in the last six weeks is the pink elephant in the corner of the room. Here's a broken chart:

US Initial Jobless Claims, 1967-Present | Source: Bloomberg, April 23rd

The number of Americans who have lost their jobs in the last six weeks exceeds the labour force of Canada. Roughly a quarter of Hawaii and Kentucky labour force have lost their jobs in this period. If the experience of the 2008 Financial Crisis is anything to go on, a significant fraction of those who lost their jobs will not have jobs to go back to when all of this is over. The drag that number of unemployed will place on economic recovery could be significant.

To think on the bright side, long-dead Austrian economist Joseph Schumpeter liked to talk about events like this as "creative destruction," a process of "industrial mutation" not unlike a snake shedding its skin. With the capacity freed up by the destruction of the old order, the thinking goes, we should be able to build a shining new one.

One thing is certain: we have seen the destruction. Now we start waiting for the creative part.

More on Market Updates:

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!