You'll Never Pick the Bottom

A month ago, we started recommending a basket of large, dividend-paying stocks that had reached impressive yields. A lot of people thought we were crazy buying into a market that was falling off a cliff, and in some cases they were right. The volatility this basket has exhibited since we recommended it is well above average. Below is the performance of this basket (which includes Royal Bank, TD, BMO, Scotiabank, CIBC, Enbridge, and BCE) over the course of this year:

Bloomberg: April 7th, 2020

As you can see, we didn't pick the bottom. Had we recommended our clients wait 11 days before investing, they would have seen a better return.

Why We're Still Happy With Our Recommendation

In a word: performance.

If you had invested on the day we first recommended this basket of securities, you'd have seen a 12.8% return in 18 days of trading. You would be expecting a 7.1% dividend yield. Your risks would be limited to five of the country's largest banks, its largest midstream energy company, and one of its largest telecommunication companies.

Picking the bottom is, after a certain point, an exercise in luck. A good analyst can consume the available information, examine historical trends, apply their intuition, and come up with an informed estimation of where the market is going in the next few weeks, months, and years. We can't reliably bullseye inflection points down to the day, and it would be irresponsible to pretend that we can.

Our philosophy is to identify value and take advantage of opportunities when they present themselves. If we miss the bottom by a few days, so be it. The bigger loss would be to get discouraged and not invest at all, or hold out and wait for the market to tank again. Doing so would risk missing out on this rally altogether.

The Window is Still Open

We believe that there is still value in the dividend basket we've been recommending, even as prices rise. The price-to-earnings and price-to-book ratios of the banks still suggest a buying opportunity. The dividend yields we're seeing are still attractive and we still believe that all the names in this basket will be able to pay their dividends.

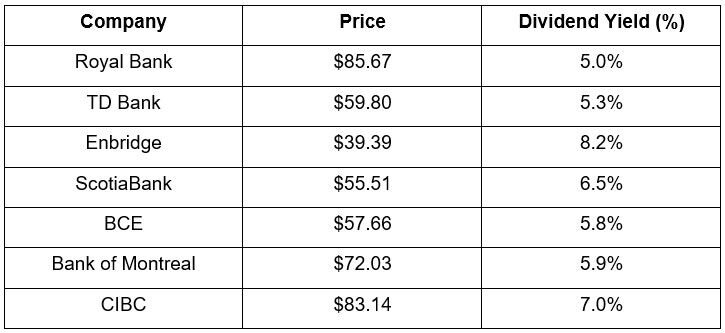

Source: ThomsonONE

That basket is currently paying a 6.2% dividend yield. Maybe we've missed the bottom, and maybe it's still ahead of us. Right now, however, we think this is good value and a good opportunity to enter the market.

Don't hesitate to reach out to us at 604.643.0101.

Disclaimer: Canaccord Genuity Corp. is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and Canadian Investor Protection Fund (CIPF). The comments and opinions expressed in this commentary are solely the work of the Cash Management Group and Andrew Johns.

More on Market Updates:

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!