Federal Reserve Takes Rates to 22-Year High

The Federal Reserve announced Wednesday that it will raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent, as stated in its Federal Open Market Committee (FOMC) statement.

In response to recent indicators signaling a moderate pace of economic expansion, robust job gains, and elevated inflation, the Federal Reserve has taken decisive action. The Federal Reserve's Committee seeks to achieve maximum employment and maintain inflation at a rate of 2 percent over the longer term, aligning with its statutory mandate.

Presently, the inflation rate in the United States stands at 3 percent, its lowest since March 2021.

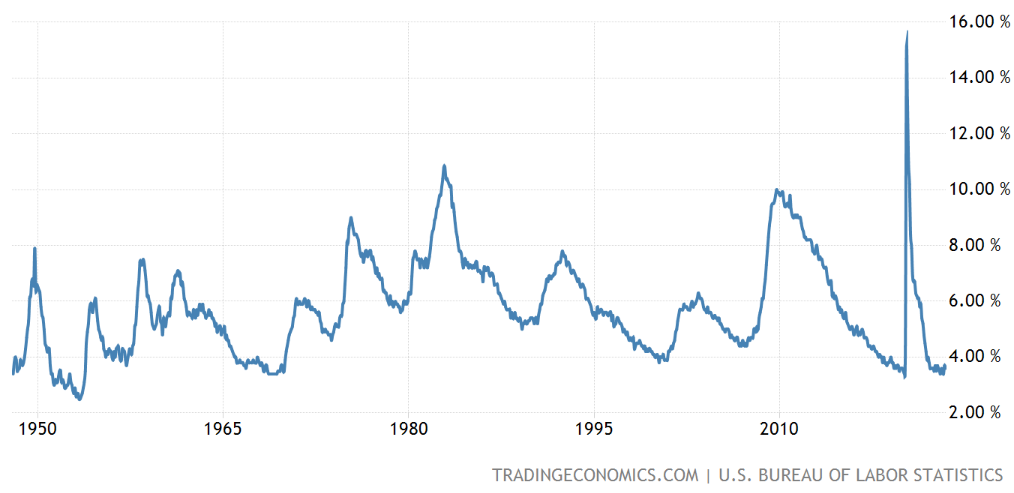

This move to raise interest rates by 25 basis points comes in light of the solid job gains in recent months, which have effectively kept the unemployment rate at a historically low level of 3.6 percent.

United States unemployment rate since 1950. (Source: tradingeconomics.com)

However, the Federal Reserve acknowledges the uncertainty surrounding the effects of tighter credit conditions for households and businesses on economic activity, hiring, and inflation. Consequently, the Committee remains highly attentive to potential inflation risks.

In determining the appropriate course of action, the Committee stated it will be diligent in assessing various factors, including the cumulative impact of monetary policy tightening, the time lags involved in the transmission of monetary policy to economic activity and inflation, and developments in both the economic and financial landscapes.

Additionally, the Federal Reserve mentioned it will “continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities,” as described in its previously announced plans.

The central bank reaffirms its commitment to its long-term inflation objective of 2 percent and aims to closely monitor incoming information for its implications on the economic outlook. Should any risks emerge that could impede the attainment of the Committee's goals, the stance of monetary policy may be adjusted as appropriate.

The Federal Reserve’s next FOMC statement is scheduled for Wednesday, Septmeber 20, 2023.

As always, if you have any questions about today’s Market Update, you can call us at 604-643-0101 or email cashgroup@cgf.com

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!