U.S. Credit Rating Downgraded to ‘AA+’ by Fitch: An Analysis

Fitch Ratings has marked a pivotal moment in the financial landscape by downgrading the United States of America's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'AA+' from 'AAA'. The announcement on 1st August 2023 also removed the Rating Watch Negative and assigned a Stable Outlook. Additionally, the Country Ceiling has been affirmed at 'AAA'.

Key Factors Behind the Downgrade

1. Fiscal Deterioration and Debt Burden:

The downgrade reflects the forecasted fiscal decline over the next three years, coupled with a rising general government debt burden. Despite reduced debt-to-GDP ratios in the last two years, the ratio is projected to reach 118.4% by 2025. Fitch's report states the debt ratio is "over two-and-a-half times higher than the 'AAA' median of 39.3% of GDP and 'AA' median of 44.7% of GDP."

2. Erosion of Governance:

The U.S. has seen a steady decline in governance standards over the last two decades, especially in fiscal and debt matters. Fitch emphasized that "repeated debt limit standoffs and last-minute resolutions have eroded confidence in fiscal management."

3. Rising General Government Deficits:

General Government (GG) deficit is predicted to rise to 6.3% of GDP in 2023 from 3.7% in 2022, highlighting cyclically weaker federal revenues, new spending initiatives, and higher interest burdens.

4. Medium-term Fiscal Challenges Unaddressed:

The Congressional Budget Office (CBO) projects interest costs to double by 2033 to 3.6% of GDP. Rising mandatory spending on Medicare and social security due to an aging population poses challenges, with depletion of specific funds forecasted by 2033 and 2035.

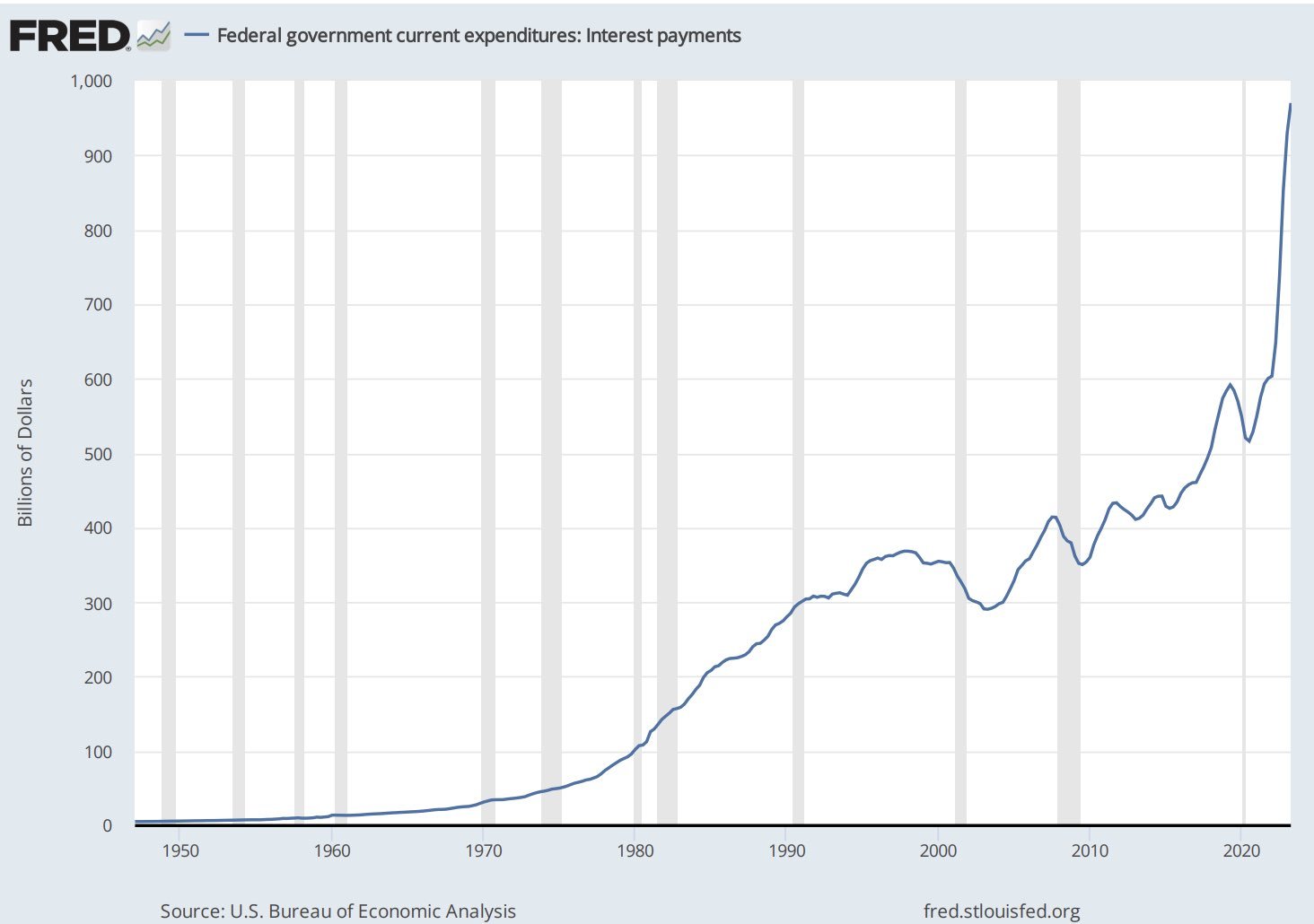

Interest expense on U.S. debt as of 2023 (Source: U.S. Bureau of Economic Analysis).

5. Recession Forecast:

Fitch anticipates the U.S. economy slipping into a mild recession in 4Q23 and 1Q24. The real GDP growth is expected to slow to 1.2% this year, followed by an overall growth of 0.5% in 2024.

Interest Rates

As of 10:30AM PST Wednesday, the market was pricing in an 18.4% probability of a 25 basis point hike for the Federal Reserve’s next FOMC Statement on September 20, 2023. Presently, the fed fund’s rate is in a target range of 5.25%-5.5%.

World Interest Rate Probability for the United States as of August 2, 2023 (Source: Bloomberg)

Exceptional Strengths

Despite the downgrade, the United States' rating continues to be underpinned by its robust, diverse, and high-income economy. A key strength lies in the U.S. dollar's status as the world's leading reserve currency, offering the government substantial financing flexibility.

Rating Sensitivities

Fitch outlines that the negative rating action could occur due to increased government debt or a decline in the coherence of policymaking that undermines the U.S. dollar's reserve currency status. Positive rating action might follow the implementation of fiscal adjustments or a sustained reversal of the trend deterioration in governance.

Fitch's downgrade of the U.S. Sovereign Credit Rating to 'AA+' from 'AAA' marks a critical evaluation of the nation's fiscal management and economic outlook. The report emphasized it's evident that "there has been a steady deterioration in standards of governance over the last 20 years," thus calling for introspection and strategic action by policymakers.

On July 28, 2023, DBRS Morningstar confirmed the U.S.’s long-term rating of ‘AAA.’

As always, if you have any questions about today’s Market Update, you can call us at 604-643-0101 or email cashgroup@cgf.com

Disclaimer: Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security.Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of CGWM USA Inc. or its affiliates. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.Investing involves risk, including risk of loss.Past performance is no guarantee of future results.Canaccord Genuity Wealth Management (USA), Inc. - MEMBER FINRA & SIPCMarket Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!