Market Update: Bank of Canada Ends Quantitative Easing

The Bank of Canada (BoC) recently announced that after a year and a half it will shift its quantitative easing program to a reinvestment phase. In other words, the Bank of Canada will stop its extensive purchase of Government of Canada bonds, and instead, it will now only purchase enough new bonds to replace those currently maturing.

The main purpose of quantitative easing is to stimulate the economy by adding to the money supply. As such, the reason for ending quantitative easing, as cited by BoC Governor Tiff Macklem, is the belief that we have seen substantial economic growth & recovery in Canada; enough so that we can begin taking off the training wheels and let the economy run on its own. Many are arguing that the growth is tied to the rising rate of inflation that we have been experiencing. Below is a graph of Canada’s Consumer Price Index(CPI), one of the most gauge for inflation.

Of course, this inflation is also due to the global supply chain issues and shortages caused by the very unusual circumstances of the COVID-19 pandemic. Unemployment is another factor contributing to inflation as it remains above pre-pandemic levels. A number of key indicators that Macklem said still need to improve before we see QE come to a complete stop.

The Bank of Canada does target a 2% inflation rate by the end of next year. There is some comfort in knowing that inflation in Canada is still markedly lower than the 12% rate in the 1980s and the astounding 18% rate in the late 1940s.

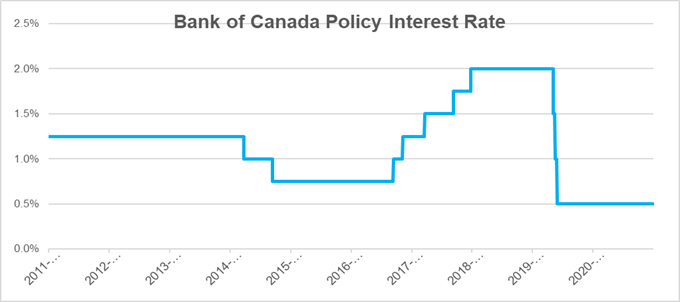

What does this mean for investors? The end of quantitative easing also comes with signals that interest rates may rise sooner than expected. Given the prospect of rising rates, we are most closely interested in the impact this will have on bond yields and mortgage rates.

As the Bank of Canada pulls back its purchase of bonds, bond prices will likely go down and correspondingly, bond yields will likely increase. Essentially, investors are now encouraged to save money instead of partaking in a manic inflationary spending spree. We are already seeing this as indicated below.

The other main impact will be on mortgages, the potential for higher interest rates could make mortgages and general borrowing more expensive. Given the rates are currently at historic lows, there is a lot of opportunity for a prepared investor to benefit. One of the many considerations for individuals is whether to lock in a mortgage rate or to refinance their home before there is any significant rise.

We recommend the ever-delightful task of reviewing your fixed income instruments (Bond, CPs, GICs etc,) and considering how a rising rate environment may affect your investments. If you need a sounding board or recommendation, you are always welcome to contact us to discuss how your situation would specifically be impacted by a rising rate environment.

If you'd like to discuss your portfolio, don't hesitate to reach out to us at 604.643.0101.

Cash Management Group

604.643.0101 | Email us

More on Market Updates:

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!