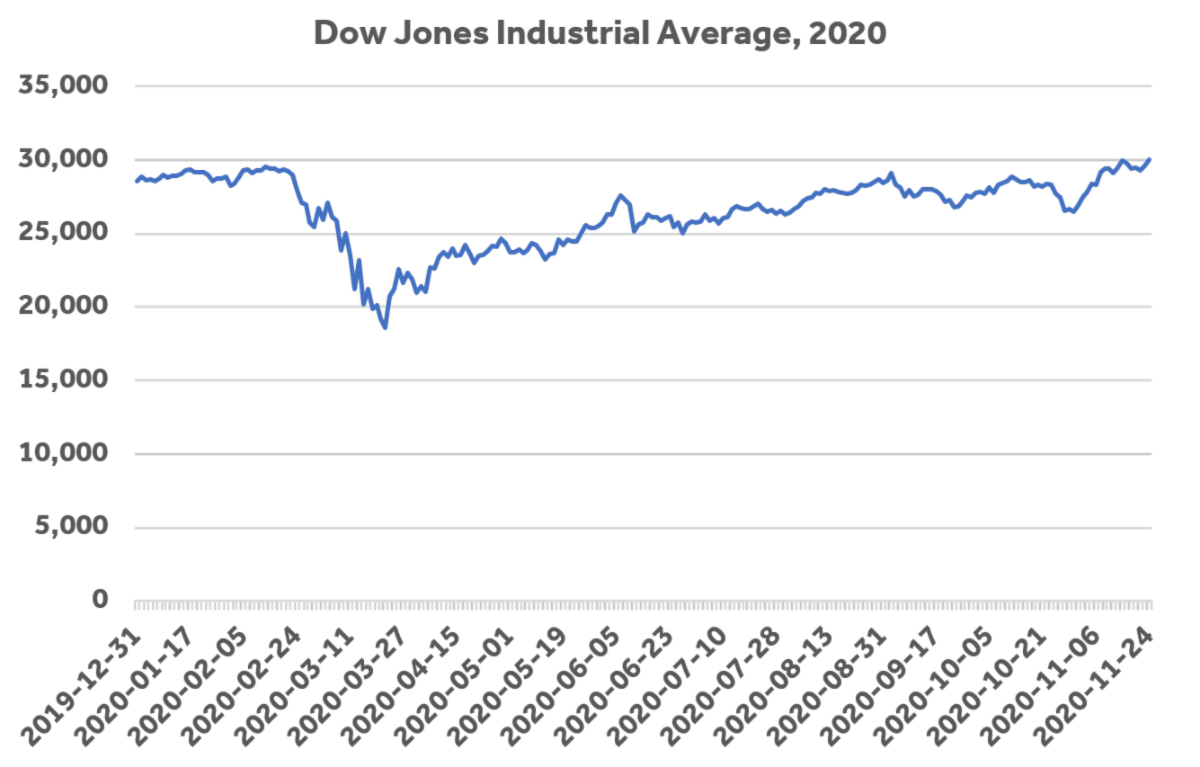

Dow Breaks Through 30,000

Today's trading saw equity markets reach an important (if totally arbitrary) milestone: the Dow Jones Industrial Average broke through 30,000 early in the session and continued to an all-time high close of 30,046.

Source: Bloomberg

No Landslide Means No Tax Increases or Dramatic Changes

We broke down the possible election day scenarios a few weeks ago, and many are still on the table. Either Donald Trump or Joe Biden could still eke out a narrow victory, pending the results of counts (and recounts) in those key states.

The one scenario that is now pretty confidently off the table is the Democratic landslide "Blue Wave" in which Joe Biden wins the presidency and the Democrats seize control of the Senate while maintaining control of the House. This would give them free reign to enact Joe Biden policy points like corporate and personal tax increases, which would have a severely deleterious effect on corporate profitability. Today, we think the market is responding to two things:

Things haven't gone absolutely bananas in the presidential election, at least not yet;

The "Blue Wave" hasn't really materialized.

There are some other isolated situations. Uber and Lyft were up dramatically on the passage Proposition 22 in the State of California, which clarifies that its drivers are in fact independent contractors and not employees. Facebook is up because nobody's blaming a wonky result on their platform (as was the case in 2016) and a split government isn't likely to break up the social media behemoth. Pharmaceutical companies are up because a split government isn't likely to lower their prices or otherwise meddle with their profitability.

As the story continues to unfold, we will bring you more updates. Until then, we expect markets to continue being volatile to both the up- and downsides.

2020 will certainly close as one of the most remarkable years in the history of public markets. A rally of 12,000 points in the DJIA is remarkable, but consider some of the following:

After falling to $72 in March, Royal Bank rallied by 49% to finish today at $107.

After falling to $89, Boeing rallied 149% to close today at $222.

The S&P 500 is up 12.5% year-to-date.

The most compelling explanations for this week's market rally come down to a mosaic of news stories that many filtered out. None of it is particularly spectacular, but it all adds up to a very positive scenario for global equities.

Biden Appointments Signals Conservative Agenda

It's not the most exciting thing in the world, but the most important part of a presidential transition is the selection of a cabinet. These are the people to whom presidential authority will be delegated, and who they are says a lot about what the incoming president hopes to achieve. This is particularly important if the president is particularly old or ideologically flexible, and Joe Biden is both. The most important cabinet announcements so far reflect a pretty moderate or even conservative project:

Janet Yellen is returning to public life as the Secretary of the Treasury. If you were afraid that Biden's administration would jump into Modern Monetary Policy and get crazy with spending: don't worry. A Brookings Institute economist and former Federal Reserve Chair is not going to play a particularly imaginative game.

Antony Blinken's selection as Secretary of State is about as conventional as it gets. Blinken has worked in the foreign policy establishment for almost 30 years, and does not imagine a radically different role in the world for the United States. Look for the US to reintegrate with international organizations and for US-led globalization to continue.

As a bonus, John Kerry as "Climate Envoy" is a sign that climate policy will be moderate. Kerry is not a radical, never has been, and his climate project will likely be limited to policies like rejoining the Paris Agreement.

Altogether, Biden's campaign promise that "nothing will fundamentally change" seems to be borne out by his selection of senior officials. The risk of a radical new Democratic administration, which was always somewhat overstated, seems to be firmly off the table. Markets tend to prefer the status quo and "business as usual," which Biden's administration seems eager to deliver.

Multiple Coronavirus Vaccines Demonstrate Efficacy

While the market did rally on news that Pfizer's vaccine candidate had demonstrated remarkable efficacy in early trials, it's possible that the two more recent announcements are even more important. Moderna announced that its own mRNA vaccine candidate had demonstrated 94% efficacy, and AstraZeneca announced its own vaccine candidate which operates in a more conventional way.

News of one effective vaccine candidate takes the worst case scenario off the table. News of three vaccine candidates from three different manufacturers that use two different modalities allays the risks associated with the first vaccine candidate, which were not insignificant. Since the vaccine candidates come from different manufacturers, have all demonstrated efficacy in different trials, and operate in two different ways, the chances that at least one will be effective, safe, and deliverable are very high.

Our Outlook

Obviously, our strategy of holding lot of cash to ride out the volatility associated with the election and start of flu season has not been rewarded by the market. However, we don't think that means it was inappropriate at the time: just because it didn't start raining doesn't mean you were foolish for bringing an umbrella.

We continue to see a lot of downside risks (in the last seven days, one person has died of COVID-19 in the US every minute) but there is a lot of good news pushing this market forward. An effective vaccine is likely on the way. The political situation, while certainly not ideal, could have been a lot worse. It looks like the global trend of low rates will continue, and equities will be one of the few sources yield available on public markets.

If you'd like to talk about these events or discuss your portfolio, don't hesitate to reach out to us at 604.643.0101.

Cash Management Group

604.643.0101 | Email us

More on Market Updates:

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!