Argentina Markets Brace for Change Following Javier Milei’s Primaries Win

Voters lining up for the national primaries polling station in Buenos Aires, Argentina (Source: Erica Canepa, Bloomberg)

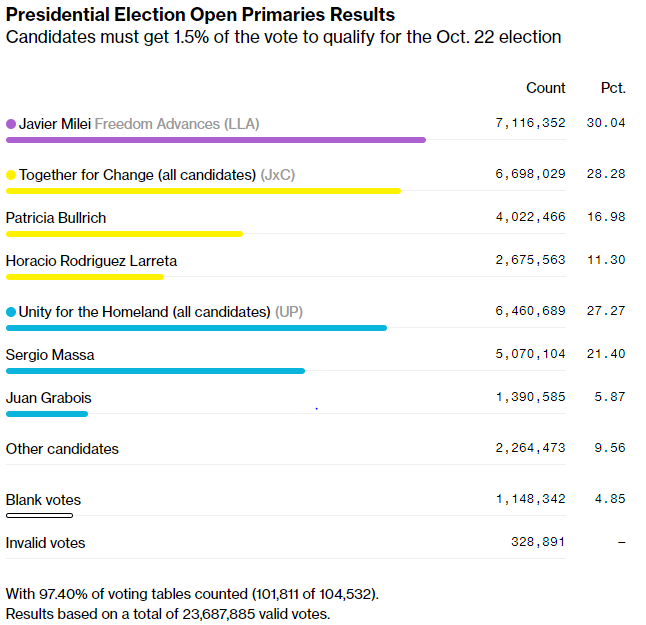

The Argentine political landscape experienced a seismic shift during Sunday's open primaries. Outsider and far-right Javier Milei topped the results, with 30.04% of the votes for "La Libertad Avanza" (LLA), based on over 90% of counted votes. Meanwhile, Patricia Bullrich emerged victorious within the "Juntos por el Cambio" (JxC) group with 16.98% of the votes, defeating Horacio Rodriguez Larreta. The incumbent left-wing faction, set to be fronted by Sergio Massa in the upcoming general election, lagged behind their rivals.

Argentina's first round of the presidential general election is set for October 22, 2023, with the main candidates facing off in a three-way contest. A decisive first-round victory requires either 45% of the vote or a 40% score with a 10-point advantage over the closest competitor.

Argentina Presidential Election Open Primaries Results - Last Updated August 14, 2023, 1:27 AM PDT (Source: Bloomberg)

A significant market reaction followed the primary results: the official FX rate surged by 22%.

With Argentina grappling with pressing economic challenges, Javier Milei's proposals could offer a new direction:

Economic Reform: Milei envisions a comprehensive overhaul of the nation's economic infrastructure, targeting sustainable growth and macroeconomic stability.

Currency Competition and Dollarization: Advocating for currency competition, Milei's stance leans towards potential dollarization of the economy, hinting at a transition to a more internationally recognized and stable currency standard.

Unified Exchange Rate: Milei seeks to stabilize and unify the myriad of exchange rates plaguing the Argentine economy.

Reducing State Expenditures: Aiming to shrink the fiscal deficit, Milei's plan calls for significant cuts in government spending.

As the October elections approach, both the electorate's choices and the market's reactions will be keenly watched by investors, all hoping for a brighter economic future for Argentina.

The future is still uncertain, so it can be beneficial to work with a broker that has experience in Argentine peso solutions.

For any questions or concerns, feel free to call us at 604-643-0101 or email cashgroup@cgf.com.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!