Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Category

Sort by Date

- January 2020

- February 2020

- March 2020

- April 2020

- May 2020

- June 2020

- July 2020

- August 2020

- September 2020

- October 2020

- November 2020

- January 2021

- March 2021

- June 2021

- September 2021

- November 2021

- January 2022

- February 2022

- March 2022

- April 2022

- May 2022

- June 2022

- July 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2023

- February 2023

- March 2023

- April 2023

- May 2023

- June 2023

- July 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2024

- February 2024

- March 2024

- April 2024

- May 2024

- June 2024

- July 2024

- August 2024

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

What will happen to Argentina’s capital controls in 2025?

During our recent visit to Argentina, we engaged with various legal and economic experts to gather insights on the future of the nation's capital controls. Despite differing opinions among these specialists, we identified key events in 2025 that warrant close attention.

Argentina’s New Monetary Scheme: Impact on the FX Gap

Since the start of Argentina's new monetary plan, which involves the Central Bank (BCRA) selling dollars from exporters, the FX gap has shrunk from 55% to 42%. Despite this, it hasn't dropped below 40%. The BCRA's strategy has focused on preventing big jumps in the BCS rate rather than aggressively narrowing the gap.

Implications of the Blue Chip Swap Rate Increase

The Blue Chip Swap (BCS) rate has experienced a significant rise from a recent low of 1,070 on May 10 to 1,245 on May 22, marking a 16% jump in just a week and a half.

Argentina 2024 Capital Controls: BOPREAL & Export Increase Program

In these challenging economic times, Argentina's business landscape presents unique complexities, particularly in the realms of international trade, import payments, and export transactions. At Canaccord Genuity, we are committed to offering tailored solutions that address these specific challenges.

Breaking the Mold: Argentina's Drastic Currency Devaluation

Argentina's bold economic reforms continue as President Javier Milei devalued the peso by a staggering 54%, pushing the official exchange rate from $366.5 to $800 pesos per US dollar.

Argentine FX Market Stability Amidst Election Turmoil and Soaring Inflation

Following the volatile response of the FX market after the primary elections, the Argentine economic and political landscape is in the spotlight. The FX market has remained stable, but Argentina continues to grapple with soaring inflation.

Argentina Markets Brace for Change Following Javier Milei’s Primaries Win

In the August 2023 primaries, outsider and far-right Javier Milei topped the results, with 30.04% of the votes for "Freedom Advances" (LLA).

The Tax Advantages of Discounted Bonds Over GICs

Discover the hidden potential of discounted government bonds and learn how they can boost your after-tax returns beyond GICs in non-registered and corporate accounts.

A Guide to Argentina’s Foreign Exchange Regulations

Argentina has a long and complex economic history, with frequent financial crises and periods of inflation. Since 2011, the government has clamped down on foreign exchange transactions and remittances to control the outflow of capital and protect the value of the Argentine peso.

Laddered Bond Strategy

Most investors want to earn more from their cash. For those seeking a higher return while minimizing risk, one option is a laddered bond strategy.

Argentina Seeking to Change IMF Reserve Target

Argentina has been in discussions with the International Monetary Fund regarding a new program to address growing economic challenges in the country. In meetings last month, Argentine government officials sought to lower a target for net reserve accumulation as it continues to face high inflation and a large debt burden.

Market Update: Argentina to Buy Back $1 Billion in Foreign Debt

Sergio Massa, the Minister of Economy for Argentina announced a USD$1 billion bond buyback last week, as the nation looks to send a positive signal to markets.

Market Update: Brazil Congress Attacked by Bolsonaro Supporters

Thousands of Bolsonaro supporters stormed government buildings in Brasília. At the moment, Brazil’s insurrection portrays no direct effect on Argentina.

Market Update: Argentina’s Capital Controls, VP Gets Six Years for Fraud

The prediction marks the first time private economists have placed Argentina’s potential inflation above the triple-digit number. This is a level not seen in the country since the early 1990s when hyperinflation damaged its economy.

Market Update: Argentina Debt Negotiations

Last week, Argentina’s congress approved a restructuring deal for $45 billion in debt owed to the International Monetary Fund (IMF). Following two years of negotiations, President Alberto Fernández urged his parliament to approve the deal prior to a payment of $2.8 billion due on March 22. The agreement ultimately removes the threat of an imminent default on $19 billion of repayments due this year. The terms of the agreement require Argentina to gradually reduce the budget deficit over the next three years while curbing central bank money printing in exchange for a four-and-a-half-year grace period on IMF payments.

Market Update: Argentina Midterm Elections

Argentina’s midterms legislative elections implications on The Blue Chip Swap spread.

Argentine Capital Control Extension

As you are probably aware, Argentine currency controls are still presenting obstacles for businesses who need to send money into or out of the country. Global market volatility is making this need more urgent for most investors, who need to act decisively in these uncertain times.

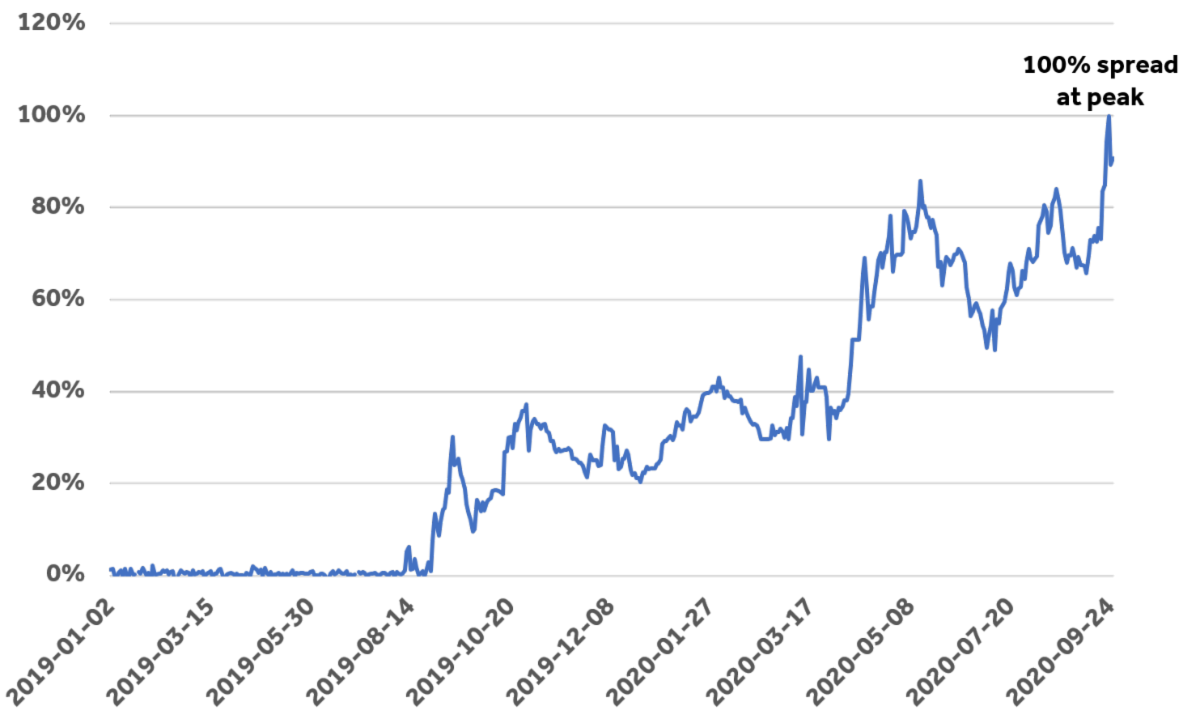

Blue Chip Swap Spread Reaches 100%

This week, we noticed that the difference between the Blue Chip Swap rate and the "official" Argentine Peso/US Dollar exchange rate reached 100%.

Using the Blue Chip Swap to Cover Fixed Costs in Argentina

With Argentina under a national quarantine until at least the middle of April, many of our clients who previously funded their operations in Argentina locally are no longer able to produce revenue. These clients are covering the fixed costs of their operations in Argentina by using the Blue Chip Swap, which allows funds to quickly, efficiently, and safely be transferred into Argentina.

Argentine Capital Controls Still in Place

As you are probably aware, Argentine currency controls are still presenting obstacles for businesses who need to send money into or out of the country. Global market volatility is making this need more urgent for most investors, who need to act decisively in these uncertain times.