Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Category

Sort by Date

- January 2020

- February 2020

- March 2020

- April 2020

- May 2020

- June 2020

- July 2020

- August 2020

- September 2020

- October 2020

- November 2020

- January 2021

- March 2021

- June 2021

- September 2021

- November 2021

- January 2022

- February 2022

- March 2022

- April 2022

- May 2022

- June 2022

- July 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2023

- February 2023

- March 2023

- April 2023

- May 2023

- June 2023

- July 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2024

- February 2024

- March 2024

- April 2024

- May 2024

- June 2024

- July 2024

- August 2024

- September 2024

- October 2024

- November 2024

Light at the End of the Tunnel?

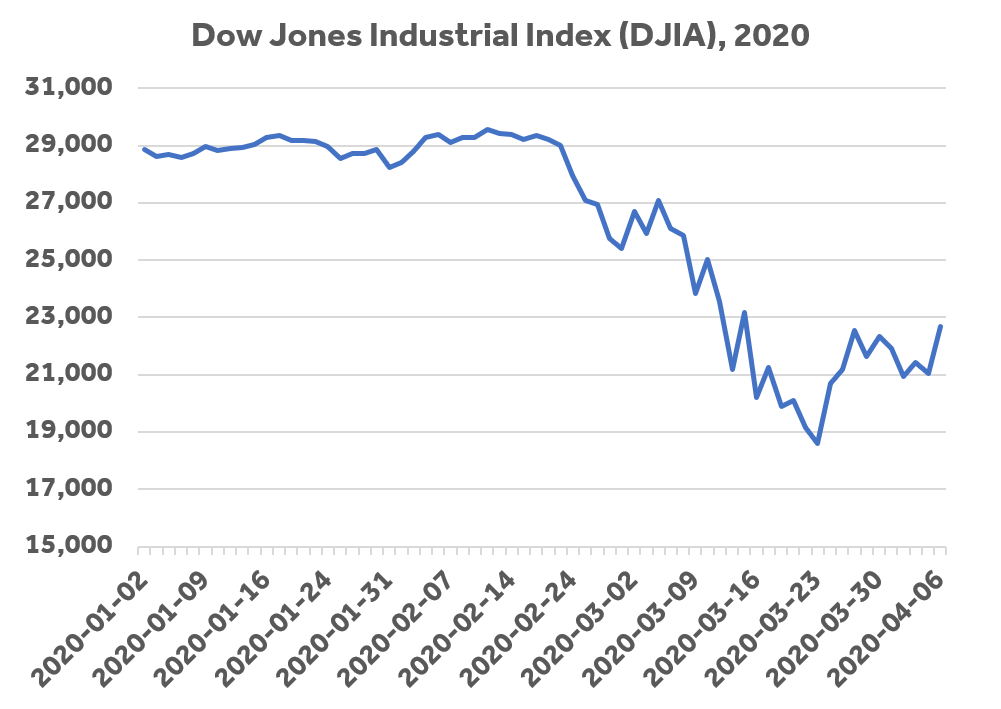

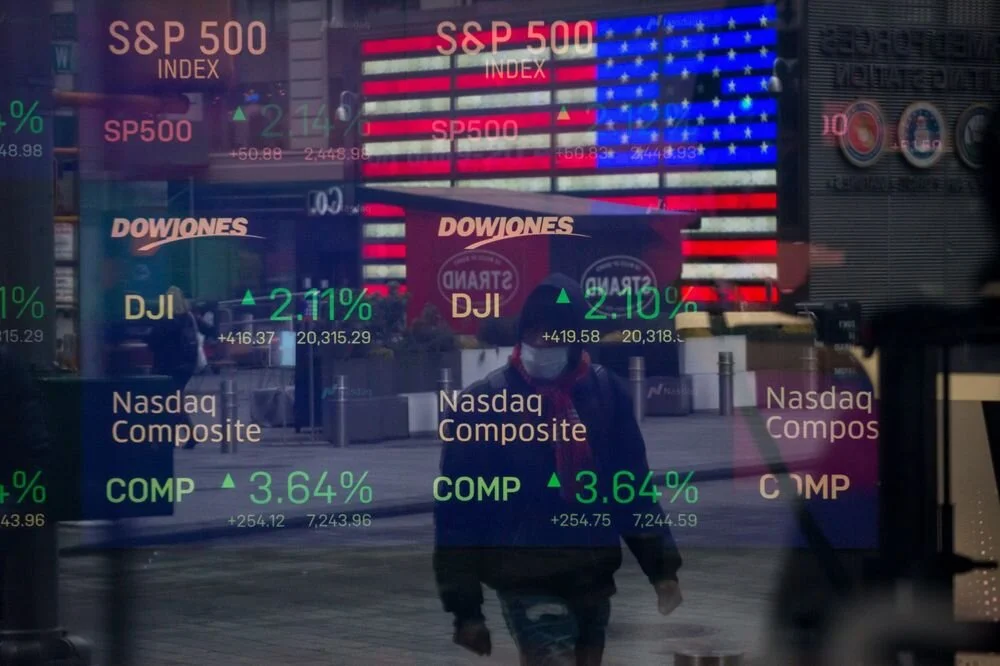

Entering a week that the US Surgeon General warned would be "the hardest and saddest" in most American's lives, you might not expect a broad rally in global equity markets. But that's what we saw, with the Dow Jones Industrial Index gaining more than 1,600 points and the S&P 500 up more than 7%.

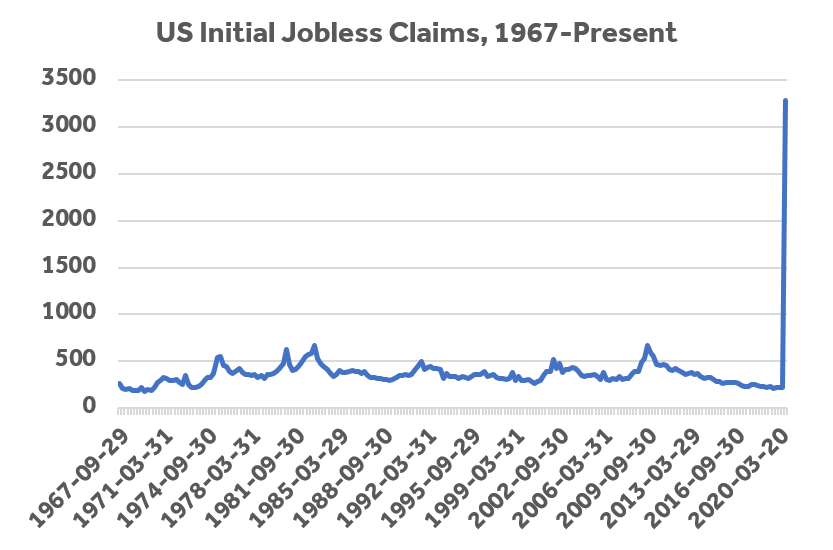

6.6 Million Americans File for Unemployment, Market Rises

Last Thursday, we brought you news of what might have been the single worst economic datapoint ever published by a developed country. This week, that number has been more than doubled, as 6.6 million people filed for unemployment in the United States last week.

Using the Blue Chip Swap to Cover Fixed Costs in Argentina

With Argentina under a national quarantine until at least the middle of April, many of our clients who previously funded their operations in Argentina locally are no longer able to produce revenue. These clients are covering the fixed costs of their operations in Argentina by using the Blue Chip Swap, which allows funds to quickly, efficiently, and safely be transferred into Argentina.

Market Rallies on Worst-Ever Unemployment Claims

Today's trading saw strong gains for the major indexes. The Dow Jones Industrial Index closed up 1351.6 points, gaining 6.4% on the day. The S&P 500 closed up 6.2%, and S&P/TSX composite gained 1.8%.

Have We Reached the Bottom, or is a Dead Cat Bouncing?

This market rally could be a "relief" rally, or a headfake rally, the proverbial "dead cat bounce", or genuinely the capitulation point that the bull market to come will be referenced against. Which is it?

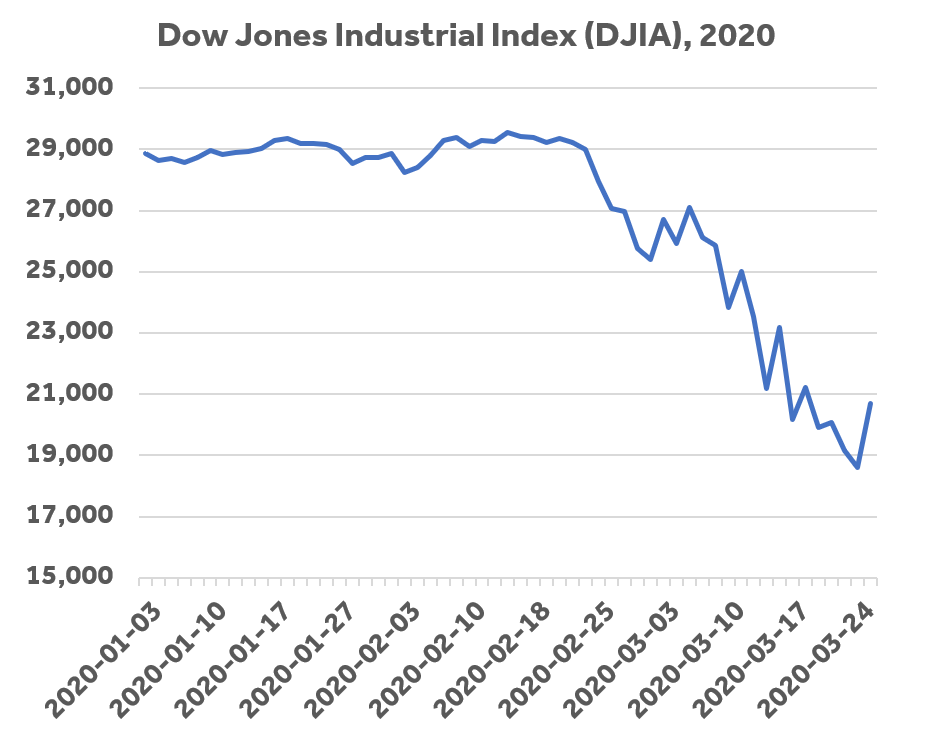

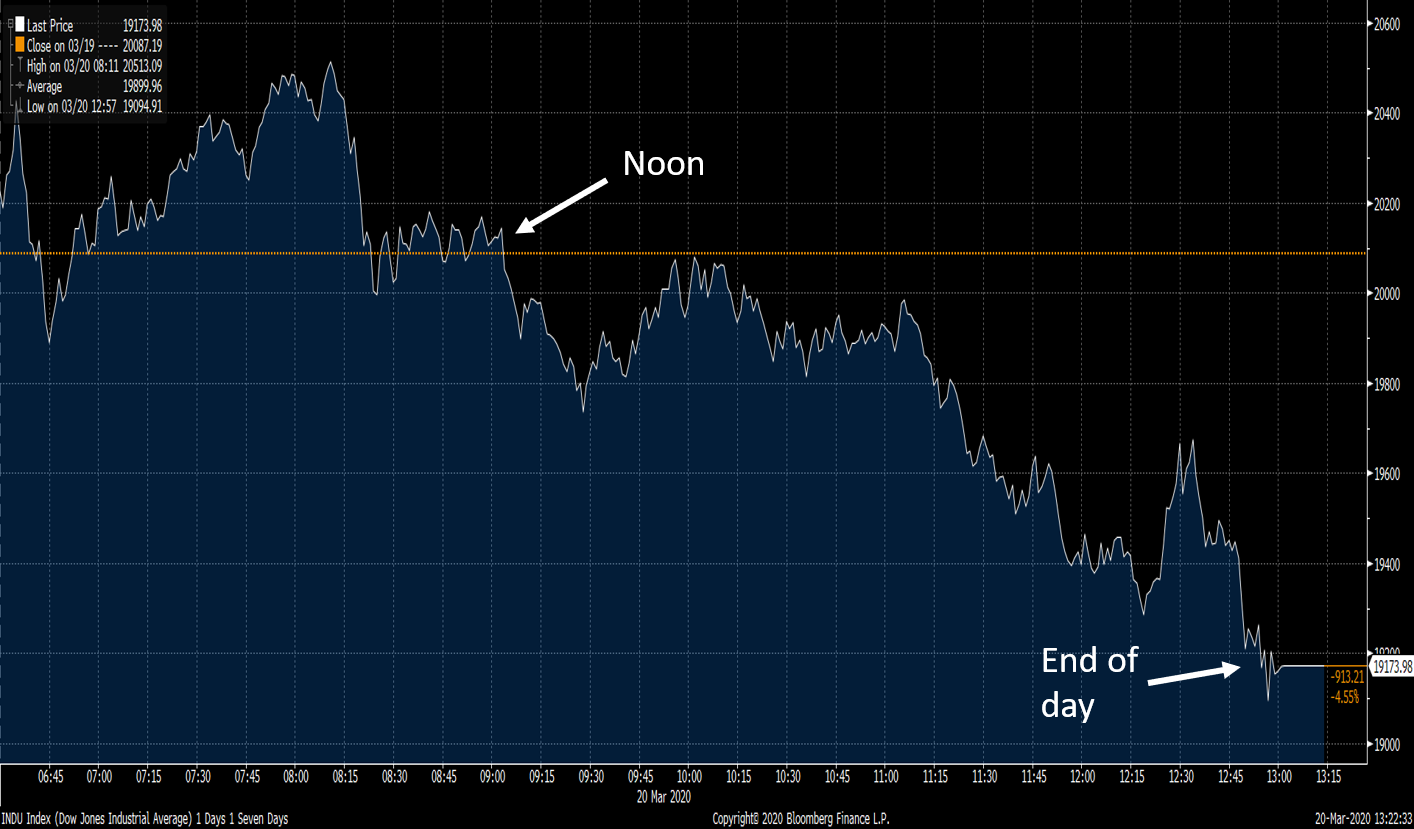

Stocks Plunge Heading Into Weekend

If you tuned out of the market at noon, you should check your portfolio again. After a calm morning, traders around the world decided that they need to risk-off for the weekend. You can understand the logic: two days is approximately twelve and a half years in today's market. Remember that it wasn't long ago that the Fed met on a Sunday to cut rates to zero.

Markets Pause Losses, Dow Over 20k

Bailouts for the aviation industry are a hot topic right now. On one hand, companies like Delta are coming under fire for billions in stock buybacks over the last few years. On the other, commercial aviation is a huge part of North America's transportation infrastructure, and allowing it to crumble now would surely hamstring the post-Coronavirus recovery. A middle ground, bailouts from cash-rich private equity leviathans like Apollo Global Management, is an interesting scenario to think about.

Dow Falls Below 20K as Stimulus Packages Announced

Today, the Dow Jones Industrial Index fell below 20,000, a mark it first achieved on January 25th, 2017. To give you an idea of how dramatic this drop is, just six weeks ago "Dow 30k" hats were the hot commodity for millenials who wanted everyone to know that they work in finance. You can still buy those hats, although you can also buy "Dow 20k" hats at the same webstore and t-shirts that read "Panic at the Costco." Sometimes pop culture is our best market indicator.

Market Dives Despite Quantitative Easing

Yesterday, in a highly unusual Sunday meeting of the US Federal Reserve's Federal Open Market Committee, the FOMC announced a 100 basis point cut to its overnight target rate and $700 billion of quantitative easing. These extraordinary steps to provide liquidity and ensure continued functioning of the global financial system joined the Bank of Canada's decision to cut rates at an emergency meeting on Friday.

Dividend Yields at All-Time Highs

Market volatility is causing a sell-off in equities around the world. A combination of panic-selling from retail investors, margin calls, and forced redemptions is continuing to push stock prices lower and lower. Pushing stock prices lower has the effect of raising the yield on their dividends, which are listed on a dollars per share basis. We're seeing the dividend yields on some large-cap dividend-paying names reach extremely attractive levels, and we're reaching out with this opportunity.

All's Fair in Love and Price War

Last weekend, the cartel that controls global oil production met to discuss cutting production in light of the global dip in demand. Those negotiations failed, and now Saudi Arabia and Russia (the two largest producers of oil outside of the United States) are instead engaging in a "price war," ramping up production to their highest levels ever. The effect on the price of oil, already brought down by the lack of demand, was dramatic:

Argentine Capital Controls Still in Place

As you are probably aware, Argentine currency controls are still presenting obstacles for businesses who need to send money into or out of the country. Global market volatility is making this need more urgent for most investors, who need to act decisively in these uncertain times.

Avoid Getting Crushed by Falling Rates

The last few weeks have been a time of severe market volatility and we understand that this is a concern to our clients. Most importantly for our cash management clients, the Bank of Canada announced a 50 basis point cut to its overnight rate target, following the Federal Reserve's emergency meeting to lower its target range.

Here's Why Your Prime-Linked Deposit Rates are Falling Today

This morning, the Bank of Canada (BoC) announced a 50 basis point cut to the overnight rate target, the benchmark rate that all Canadian fixed-income is measured against. This leaves the overnight target rate at 1.25%, down from its previous level of 1.75%.

Fed Rate Tanks. Biggest Cut Since 2008. Next Up... Canada?

This morning, the US Federal Reserve held its first emergency meeting of the Federal Open Market Committee (FOMC) since 2008 and announced a 50 basis point cut to its main policy rate. This cut, which brought the target range from 1.50-1.75% to 1.00-1.25%, was in response to the turmoil in global markets observed over the last week and the obvious slowdown in economic activity caused by the COVID-19 outbreak.

Long Term Bond Yields at Record Lows

With this week's losses in global equity markets, we're seeing the yields on long-term bonds fall to record lows. As investors flee equity markets, the price of low-risk assets like long-term US and Canada bonds gets pushed upwards, and yields correspondingly fall.

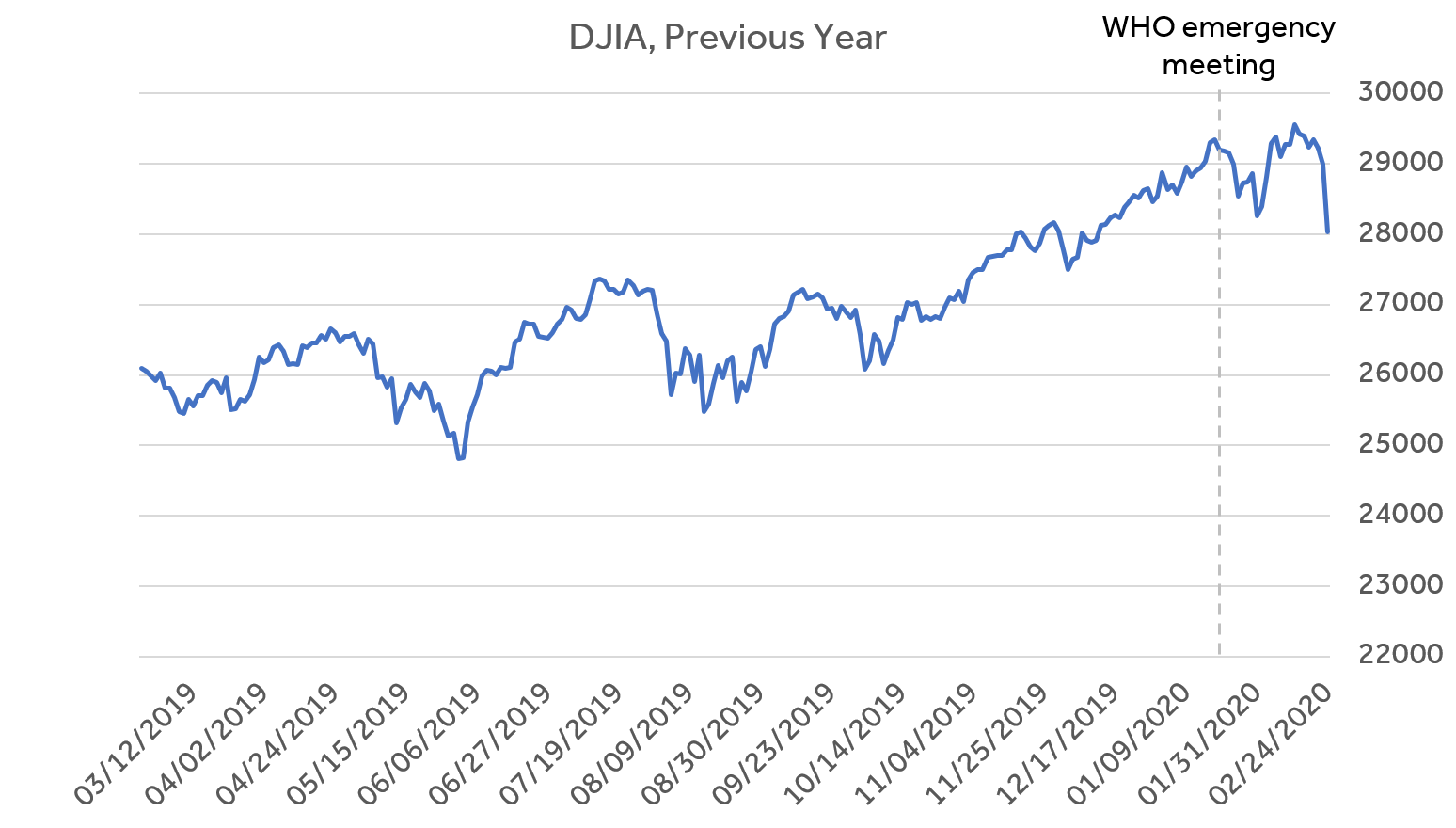

Market Update: Dow Drops Over 1,000 Points

Yesterday, the Dow Jones Industrial Average (DJIA) closed down 1,031 points, its largest drop since February 2018. This drop, which erased all of the Dow's 2020 gains, can be attributed to a few factors: Heavy overnight losses in Europe and Asia, Bernie Sanders' strong win in Nevada, which established him as the front-runner for the Democratic nomination, Outbreaks of novel coronavirus (COVID-19) in Iran, Italy, and South Korea

ABCs of SRI

Socially Responsible Investing (SRI) also known as sustainable or "ethical" investing is the blanket term for all investing that aims to achieve positive and sustainable goals, as well as competitive return.

Socially responsible investing is an approach that considers the social and environmental consequences of investing. SRI investors ask: Is this portfolio helping fund positive change?

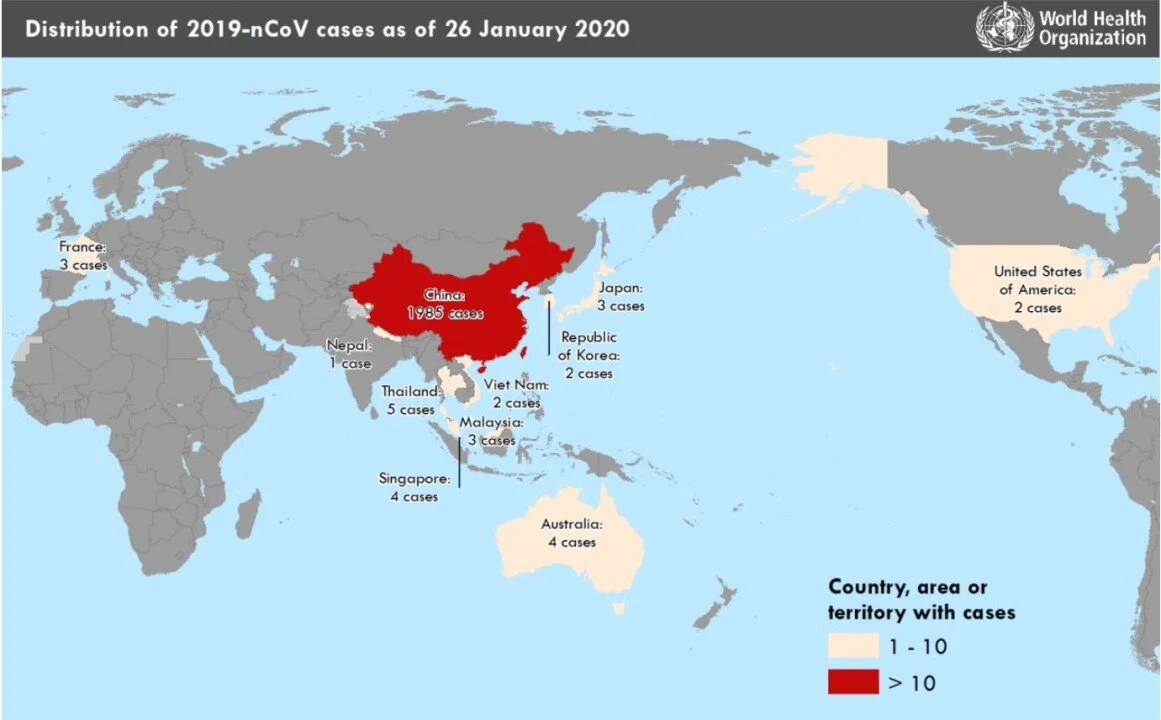

How Viral Outbreaks Affect Markets

An outbreak of Coronavirus in Wuhan, the capital of China's Hubei province, has dominated headlines. Currently, the Public Health Agency of Canada, the WHO, and the CDC are advising travelers to exercise enhanced caution while travelling to or from China. A global alert has not yet been issued.

Bank of Canada Holds Despite Slower Growth

This morning, the Bank of Canada (BoC) held the overnight target rate at 1.75%. In the Bank's press release, however, there were suggestions that a rate cut could be in the cards if growth continues to fall short of projections.