Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Category

Sort by Date

- January 2020

- February 2020

- March 2020

- April 2020

- May 2020

- June 2020

- July 2020

- August 2020

- September 2020

- October 2020

- November 2020

- January 2021

- March 2021

- June 2021

- September 2021

- November 2021

- January 2022

- February 2022

- March 2022

- April 2022

- May 2022

- June 2022

- July 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2023

- February 2023

- March 2023

- April 2023

- May 2023

- June 2023

- July 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2024

- February 2024

- March 2024

- April 2024

- May 2024

- June 2024

- July 2024

- August 2024

- September 2024

- October 2024

- November 2024

- December 2024

- January 2025

- February 2025

- March 2025

- April 2025

Fed Reiterates Firm Stance on Interest Rates

On Friday, August 26, the annual Jackson Hole Symposium was held in Wyoming. Each year the Federal Reserve-sponsored conference focuses on critical economic issues facing the world economy. This year, the focus was on Fed Chair Jerome Powell and the Federal Reserve's stance on using interest rates to battle inflation going forward. Comments made by the Fed not only pertain to the US, but many central bankers and finance ministers globally also look to the US for guidance

Canadian Inflation Decelerates for First Time in a Year

Canada’s inflation rate showed signs of slowing down, but we are not out of the woods just yet. The Consumer Price Index (CPI) for July increased 7.6% year-over-year, down from 8.1% in June. This was the first month-over-month disinflation since July 2021.

Federal Reserve Hikes Rates by 75 Bps for Second Consecutive Time

The Federal Reserve increased its main policy rate by 0.75% for the second time in a row. This is the United States’ fourth rate hike of 2022, increasing the benchmark interest rate to a target range of 2.25% to 2.50%.

Is it Hot in Here or is it Just Inflation?

The May CPI data out of the US came in much hotter than expected. Most analysts had expected year over year inflation to hit 8.3% but instead flew right past that to a new 40 year high of 8.6% (highest since 1981). The inflation numbers are being led by food and energy prices, which even when excluded; still puts inflation at an eye watering 6% year over year. Canadian energy and mining stocks declined as commodities fell after China imposed new lockdowns in parts of Shanghai, lowering the demand outlook. U.S. stocks also fell for a second day as concerns grew after Europe’s central bank became the latest to signal restrictive policies to combat inflation. The ECB made no change to the deposit rate, which was widely anticipated, but is preparing to hike by a quarter-point next month, and again by either that amount or more if inflation persists. In Canada the labour force survey was released today and showed a concerning increase in private sector unemployment (up 2%) and a shift to public sector jobs – an increase of 11%.

Market Update | Are We Seeing Peak Inflation?

On Wednesday, May 18, Statistics Canada released April’s inflation report with a year-over-year increase of 6.8%, increasing marginally from the 6.7% recorded in March 2022. This new 31-year high deviated from economists' expectations of a slight decrease from last month. This begs the question, are we seeing the peak of this challenging inflationary environment or will it continue to edge higher?

Market Update | Income in Down Markets: Where Should You Put Your Money?

This year has been extremely difficult for global stock as markets have struggled with inflation fears, rising interest rates, the Russia-Ukraine War, and lingering effects of the COVID-19 pandemic. In North America, every major index is negative on the year. The TSX is the breadwinner with a whopping -7.24% return YTD and the biggest loser being the NASDAQ at -27.32%.

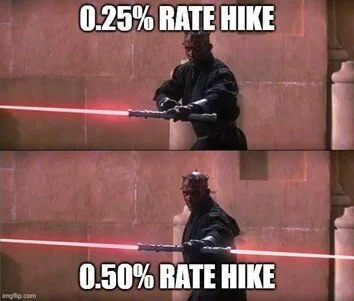

Market Update | The Fed Strikes Back

The Federal Reserve announced its second rate hike of 2022 to increase the benchmark interest rate from 0.50% to 1.00%. This is the first 50 basis point hike since 2000 and the first time the central bank raised rates in back-to-back meetings since 2006.

Market Update | US GDP Report: What is Stagflation?

You may have heard economists talking about the risk of “stagflation” following news the US economy shrank in the first quarter of 2022. But what is stagflation exactly and should you be worried?

Market Update: Argentina Debt Negotiations

Last week, Argentina’s congress approved a restructuring deal for $45 billion in debt owed to the International Monetary Fund (IMF). Following two years of negotiations, President Alberto Fernández urged his parliament to approve the deal prior to a payment of $2.8 billion due on March 22. The agreement ultimately removes the threat of an imminent default on $19 billion of repayments due this year. The terms of the agreement require Argentina to gradually reduce the budget deficit over the next three years while curbing central bank money printing in exchange for a four-and-a-half-year grace period on IMF payments.

Market Update: Economic Impact of Russia’s Invasion of Ukraine

With the news of Russia’s invasion of the Ukraine, the economic impact of the conflict has already been felt.

The political factors involved in Russia’s military action against its neighbouring nation are complex and date back to the Second World War. We recognize that this is not a simple situation that can be explained away from a financial perspective either. But with so much uncertainty, the focus that we have is the impact that this news will have on our clients. We do hope that all those involved and affected by these circumstances, whether Ukrainian, Russian, or otherwise will come to a swift and peaceful resolution.

Market Update: Shaky Start

North American markets saw one of their worst weeks post-pandemic from Jan. 17th to 21st and the bleeding has continued into this week with markets opening deep in the red on Monday. Investor’s sentiment is currently cautious/bearish due to the impending rate hikes from Central banks, Q4 earnings season, inflation numbers, and heightened tensions in Ukraine.

Market Update: Red Friday

Due to the new COVID-19 variant, the markets have been put in a state of flux. Investing in blue-chips with dividends may seem obvious but it is reliable.

Market Update: Argentina Midterm Elections

Argentina’s midterms legislative elections implications on The Blue Chip Swap spread.

Market Update: Floods Exacerbate Supply Chain Issues

How the recent floods in Abbotsford and Chilliwack are causing significant supply chain issues.

Market Update: Bank of Canada Ends Quantitative Easing

Bank of Canada will shift its quantitative easing program to a reinvestment phase.