Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Category

Sort by Date

- January 2020

- February 2020

- March 2020

- April 2020

- May 2020

- June 2020

- July 2020

- August 2020

- September 2020

- October 2020

- November 2020

- January 2021

- March 2021

- June 2021

- September 2021

- November 2021

- January 2022

- February 2022

- March 2022

- April 2022

- May 2022

- June 2022

- July 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2023

- February 2023

- March 2023

- April 2023

- May 2023

- June 2023

- July 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2024

- February 2024

- March 2024

- April 2024

- May 2024

- June 2024

- July 2024

- August 2024

- September 2024

- October 2024

- November 2024

Market Climbs as Votes Are Counted in US

Nearly 24 hours have passed since the final polls closed

How Will the US Election Affect the Market?

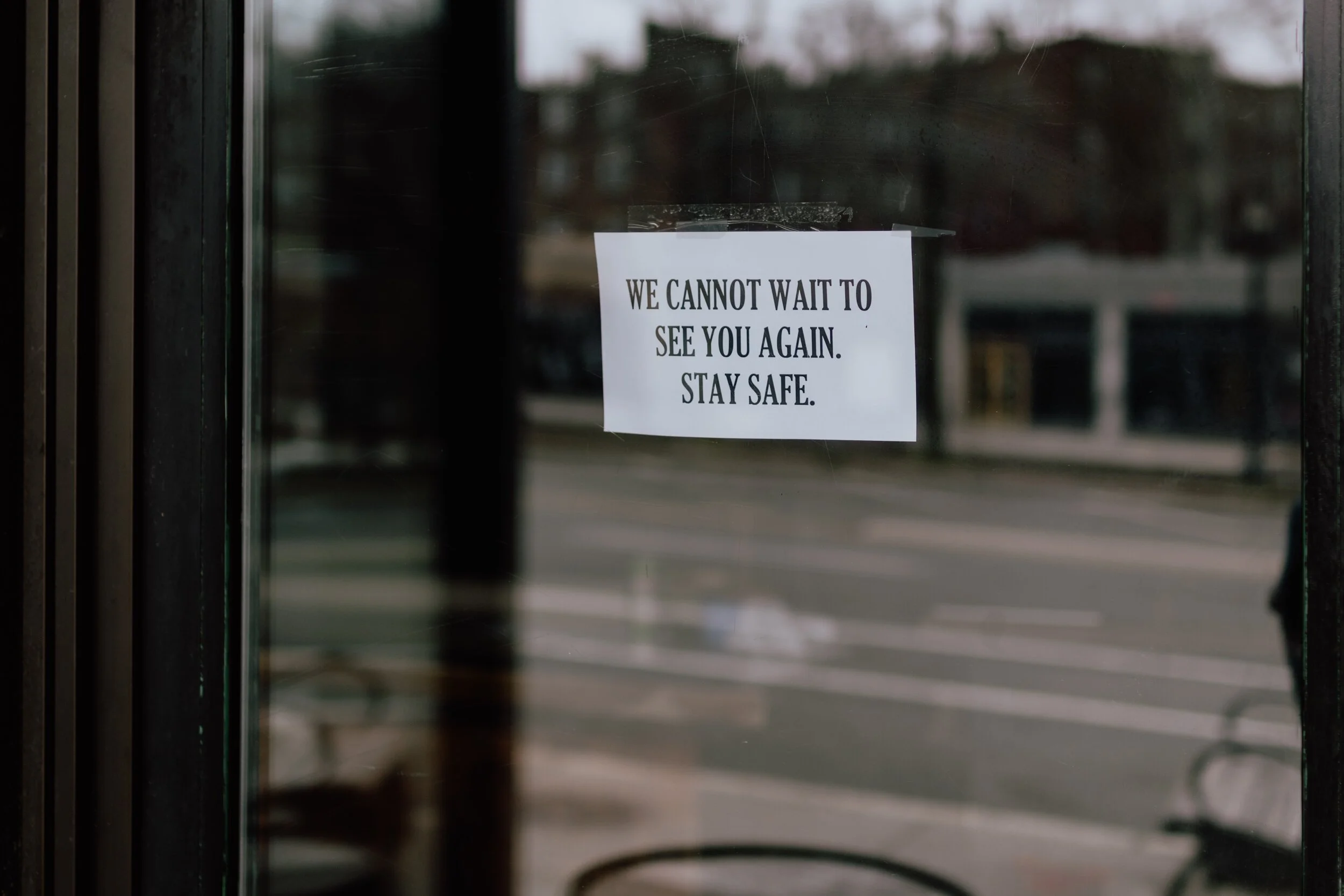

Our continuing coverage of COVID-19's effect on global markets

Blue Chip Swap Spread Reaches 100%

This week, we noticed that the difference between the Blue Chip Swap rate and the "official" Argentine Peso/US Dollar exchange rate reached 100%.

US Federal Reserve Updates Longer-Run Goals and Strategy

Our continuing coverage of COVID-19's effect on global markets

What Long Term Quantitative Easing Means for Your Portfolio

Our continuing coverage of COVID-19's effect on global markets

Price of Gold Reaches All-Time Highs

Gold reached US$1900/oz in the last few days and is closing in on an important milestone: US$2000/oz. Should it break through that barrier, it could be on track to run significantly higher.

Banks Add Almost $300B in Cash

The cash position of Canada's domestic banks, which typically grows at a few percent a year as the carefully tuned balance sheets of banks keep up with economic growth, almost doubled in the first few months of 2020, growing from $310 billion at the end of 2019 to $604 billion at the end of April.

S&P 500 Opens Above 3,000

Today's trading was positive, with the Dow Jones Industrial Average gaining almost 2% from its previous close, and the S&P TSX Composite gaining 0.5%. The big news, however, was the S&P 500 opening above 3000 and closing at 3036.25.

12% of Canadian Mortgages in Arrears, Key Oil ETF Hits Snag, Unemployment Continues to Rise

This week saw the release of some grim economic data, a weird twist on the oil problem, some positive days of trading, and the beginning of the reopening process for North America.

13% Canadian Unemployment, Insolvencies, Dividend Cuts

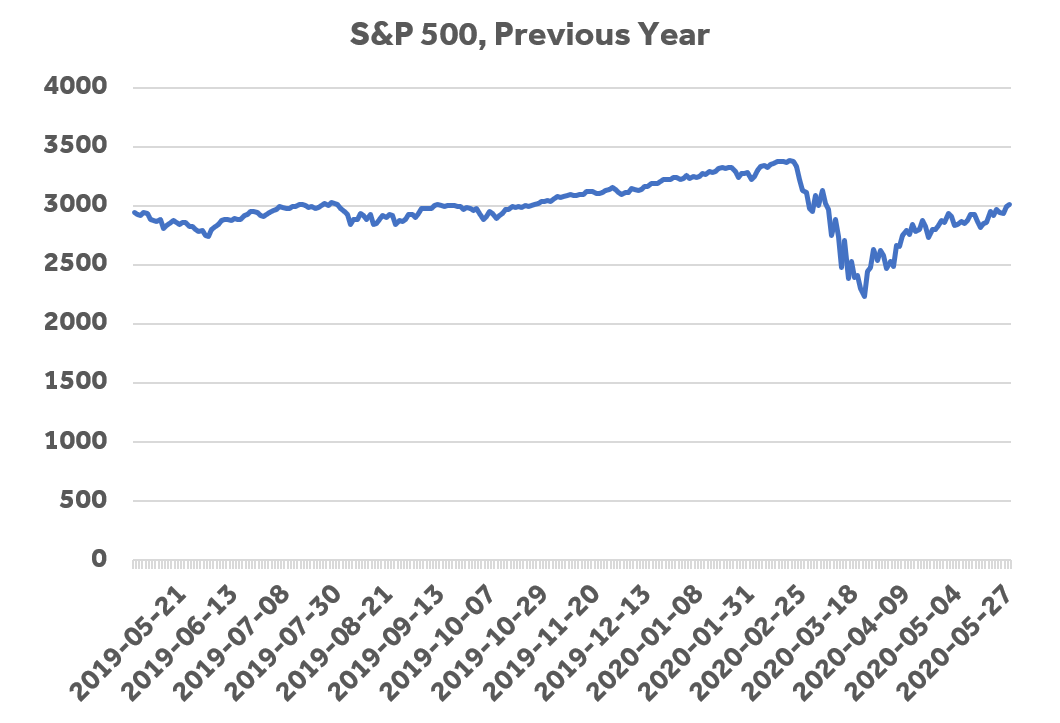

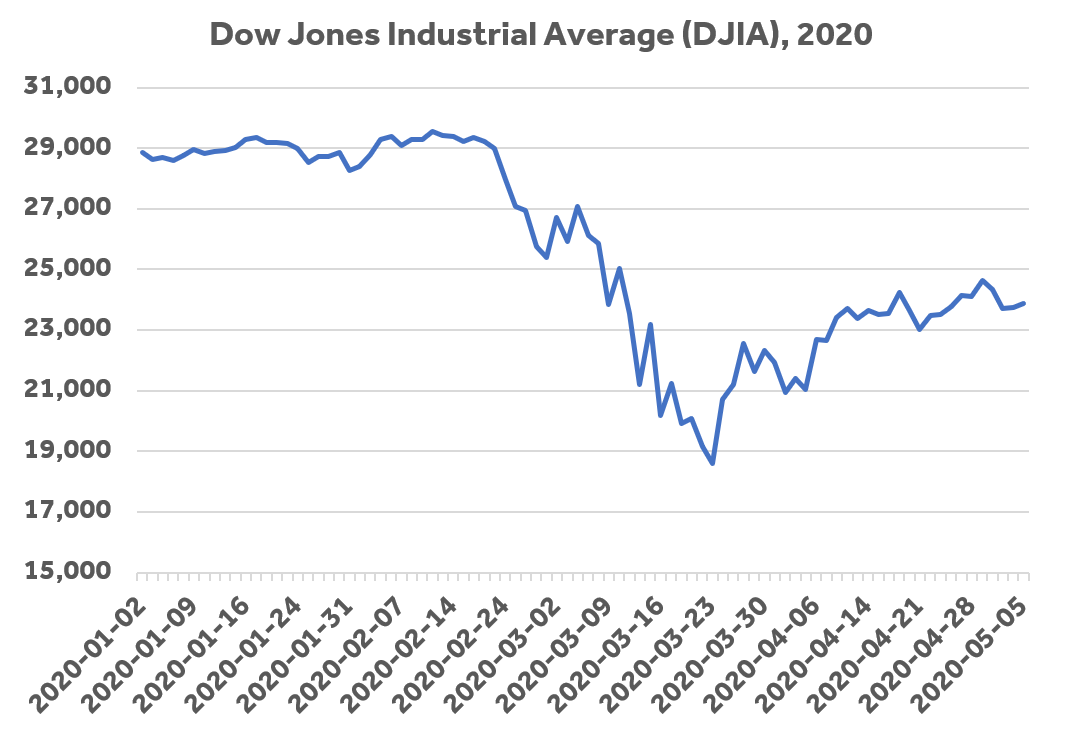

This week's trading was broadly positive, with most major indexes consolidating the rapid gains they made after the March 23rd lows. The Dow Jones Industrial Average is over 24,000, and the S&P 500 has actually gained over the last year.

Oil Rallies Above $30/Barrel

Today's trading continued the broadly unspectacular but positive gains we've seen over the past couple weeks. The S&P/TSX Composite Index closed up 0.5%, the Dow Jones Industrial Average closed up 0.6%, and the S&P 500 closed up 0.9%.

Market Down, Oil Up, Shell Cuts Dividends

After a string of positive days, today global equity markets stepped back. The S&P 500 fell 0.9%, the Dow Jones Industrial Index fell 1.2%, and the S&P/TSX Composite fell 2.9%.

Oil Down 20%; DOW Over 24,000

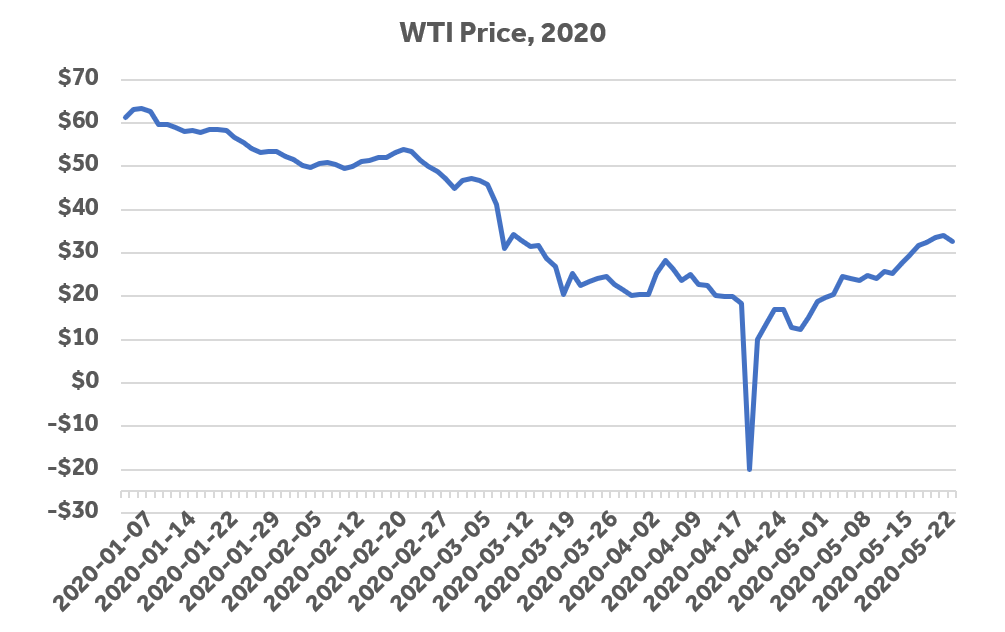

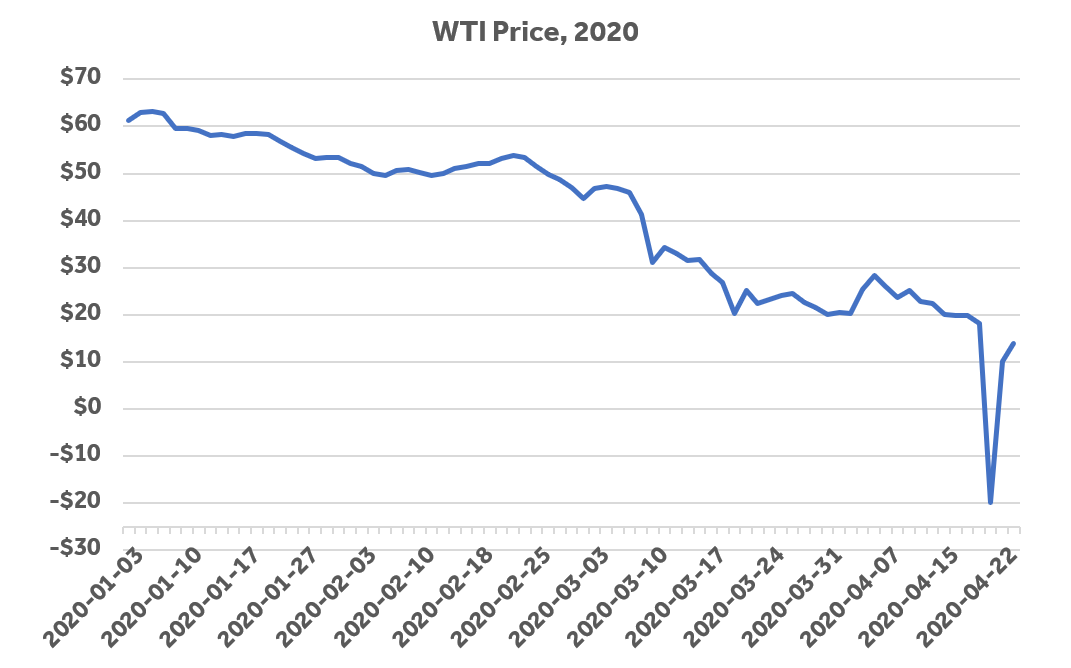

Today's trading continued last weeks light gains, with the Dow Jones Industrial Average closing above 24,000 for the second time since March 10th. Volatility in WTI oil continued apace, as the price of June WTI contracts declined more than 20%, but Brent Crude closed down 6.3%.

Who Does Well in a Recovery?

Today's trading lacked the sizzling action of previous weeks, although that's likely a welcome change. The Dow Jones Industrial Average closed up 1.1%, the S&P/TSX Composite gained 1.2%, and the price of oil (Brent crude, to be precise) added 2.4% after a wild week, closing down 22% from last Friday.

Oil Price Rallies From Historic Lows

Today's trading saw a lift in global equity markets, with the Dow Jones Industrial Average increasing by over 500 points and the S&P/TSX Composit closing up 2.4%. The real story, of course, was oil, which rebounded sharply, with the price of WTI closing up 20%.

What Does a Negative Oil Price Mean?

Today's headlines were dominated by a paradoxical piece of news: the price of oil has gone negative, briefly reaching -$37/barrel USD. But what does that actually mean? How is the price of oil measured? Can I buy all the oil in the world and lock in an enormous profit? What does this mean for the economy, in the near, intermediate, and long term? And why does this all revolve around Cushing, Oklahoma?

5.2 Million More Americans File For Unemployment

Today was a quiet day in the markets, and the first double (not triple) digit move in the Dow Jones Industrial Average in weeks. Today's trading followed the release of US initial jobless claims data, which indicated that 5.2 million Americans filed for unemployment last week.

Bank of Canada Maintains Overnight Rate, Forecasts Recovery

The Bank of Canada last published a Monetary Policy Report on January 22nd. Although it came out just 84 days ago, it reads like a parchment scroll from antiquity. It does not include the words "COVID," "virus," or "outbreak." It predicts that growth in the Canadian economy will accelerate in 2020. To say the least, it was due for an update.

You'll Never Pick the Bottom

A month ago, we started recommending a basket of large, dividend-paying stocks that had reached impressive yields. A lot of people thought we were crazy buying into a market that was falling off a cliff, and in some cases they were right. The volatility this basket has exhibited since we recommended it is well above average.