Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Category

Sort by Date

- January 2020

- February 2020

- March 2020

- April 2020

- May 2020

- June 2020

- July 2020

- August 2020

- September 2020

- October 2020

- November 2020

- January 2021

- March 2021

- June 2021

- September 2021

- November 2021

- January 2022

- February 2022

- March 2022

- April 2022

- May 2022

- June 2022

- July 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2023

- February 2023

- March 2023

- April 2023

- May 2023

- June 2023

- July 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2024

- February 2024

- March 2024

- April 2024

- May 2024

- June 2024

- July 2024

- August 2024

- September 2024

- October 2024

- November 2024

Market Update | Income in Down Markets: Where Should You Put Your Money?

This year has been extremely difficult for global stock as markets have struggled with inflation fears, rising interest rates, the Russia-Ukraine War, and lingering effects of the COVID-19 pandemic. In North America, every major index is negative on the year. The TSX is the breadwinner with a whopping -7.24% return YTD and the biggest loser being the NASDAQ at -27.32%.

Market Update | The Fed Strikes Back

The Federal Reserve announced its second rate hike of 2022 to increase the benchmark interest rate from 0.50% to 1.00%. This is the first 50 basis point hike since 2000 and the first time the central bank raised rates in back-to-back meetings since 2006.

Market Update | US GDP Report: What is Stagflation?

You may have heard economists talking about the risk of “stagflation” following news the US economy shrank in the first quarter of 2022. But what is stagflation exactly and should you be worried?

Market Update: Argentina Debt Negotiations

Last week, Argentina’s congress approved a restructuring deal for $45 billion in debt owed to the International Monetary Fund (IMF). Following two years of negotiations, President Alberto Fernández urged his parliament to approve the deal prior to a payment of $2.8 billion due on March 22. The agreement ultimately removes the threat of an imminent default on $19 billion of repayments due this year. The terms of the agreement require Argentina to gradually reduce the budget deficit over the next three years while curbing central bank money printing in exchange for a four-and-a-half-year grace period on IMF payments.

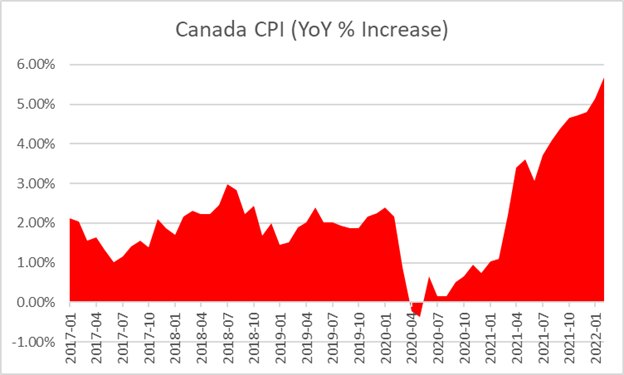

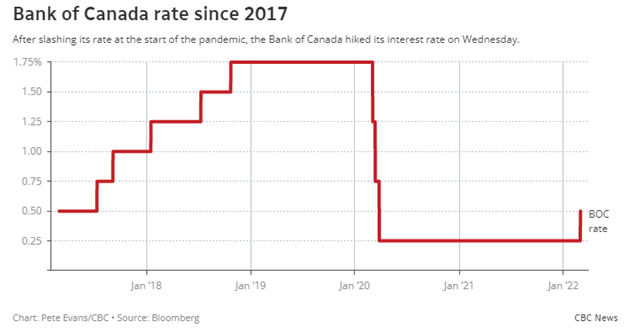

Canadian Inflation l US Interest Rate Hikes

There was monetary news coming from both sides of the border this Wednesday as the Bank of Canada released their inflation numbers for February and the US Federal Reserve announced their first rate hike since 2018 at 0.25% setting the overnight rate at 0.50%.

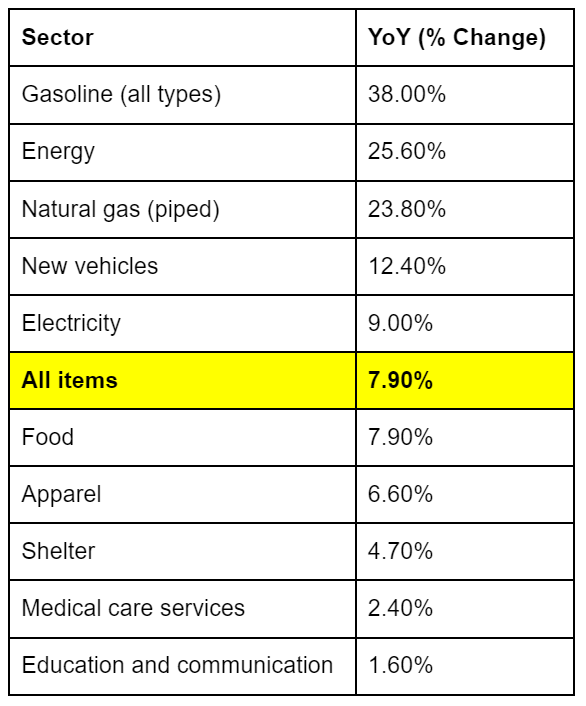

Market Update: US Inflation

Below is a breakdown of the specific consumer sectors which contribute to US inflation numbers:

Market Update: Economic Impact of Russia’s Invasion of Ukraine

With the news of Russia’s invasion of the Ukraine, the economic impact of the conflict has already been felt.

The political factors involved in Russia’s military action against its neighbouring nation are complex and date back to the Second World War. We recognize that this is not a simple situation that can be explained away from a financial perspective either. But with so much uncertainty, the focus that we have is the impact that this news will have on our clients. We do hope that all those involved and affected by these circumstances, whether Ukrainian, Russian, or otherwise will come to a swift and peaceful resolution.

Market Update: Shaky Start

North American markets saw one of their worst weeks post-pandemic from Jan. 17th to 21st and the bleeding has continued into this week with markets opening deep in the red on Monday. Investor’s sentiment is currently cautious/bearish due to the impending rate hikes from Central banks, Q4 earnings season, inflation numbers, and heightened tensions in Ukraine.

Market Update: Red Friday

Due to the new COVID-19 variant, the markets have been put in a state of flux. Investing in blue-chips with dividends may seem obvious but it is reliable.

Market Update: Argentina Midterm Elections

Argentina’s midterms legislative elections implications on The Blue Chip Swap spread.

Market Update: Floods Exacerbate Supply Chain Issues

How the recent floods in Abbotsford and Chilliwack are causing significant supply chain issues.

Market Update: Bank of Canada Ends Quantitative Easing

Bank of Canada will shift its quantitative easing program to a reinvestment phase.

How to Maximize Your RESP

Here's what you need to know about maximizing the value of your RESP.

Another TSX Milestone - What Does It Mean?

Nearly 24 hours have passed since the final polls closed

Sun Rises, World Turns, Fed Maintains Low Rates and Quantitative Easing

Nearly 24 hours have passed since the final polls closed

Argentine Capital Control Extension

As you are probably aware, Argentine currency controls are still presenting obstacles for businesses who need to send money into or out of the country. Global market volatility is making this need more urgent for most investors, who need to act decisively in these uncertain times.

What's Going on With GameStop and Blackberry?

Nearly 24 hours have passed since the final polls closed